Crypto exchanges operate in a dynamic, fast-paced environment in which the contours of competition are still evolving. However, the main parameters of competition among crypto exchanges, their economic characteristics, and current market data suggest that the sector may concentrate in the coming years. Crypto exchanges will soon attract attention from antitrust agencies, driven by an uptick in M&A, the sector’s prominence, the sheer size of crypto exchanges, and agencies’ experience with traditional trading venues. Agencies and crypto exchanges ought proactively to engage, laying the ground for an antitrust policy that supports crypto’s growth – they should not wait for the first public enforcement cases to arise. Specifically, agencies should use their advocacy functions with respect to crypto regulation; exchanges should educate officials on crypto’s procompetitive benefits; and agencies and exchanges should work together to filter complaints.

The past 18 months have seen the cryptocurrency sector facing a historic challenge. FTX, at one point the world’s second-largest crypto exchange, collapsed amid allegations of fraud, mismanagement, and misuse of customer funds. The prominent stablecoin – Luna – was all but wiped out. Celsius, a crypto lender, announced a suspension of withdrawals before filing for Chapter 11 bankruptcy in July 2022. Three Arrows Capital, a prominent hedge fund investing in digital assets, likewise saw investors liquidating their positions before filing for bankruptcy. At the time of writing, crypto-friendly banks – Silvergate, Signature, and Silicon Valley Bank – have been closed or are in the process of being taken over. And crypto businesses have had to reduce staff headcount. The market commentary has been unforgiving. At the milder end of the spectrum, analysts have predicted an extended ‘crypto winter’. Others have prophesized the end of cryptocurrencies altogether.

Crypto exchanges will play a critical role in the sector’s recovery. A crypto exchange may be the first, and possibly only, way that many investors interact with the world of crypto assets. From a legal, regulatory, and reputational perspective, exchanges are among the few identifiable actors in a sector characterized by decentralization and anonymity. And crypto exchanges are expected to facilitate new areas of growth. Aside from listing cryptocurrencies, crypto exchanges can provide a venue to trade tokenized versions of assets as wide-ranging as art, real estate, and music copyrights, enabling fractional ownership and trading in otherwise illiquid assets. This emerging use case – while still being developed – could eventually eclipse cryptocurrencies in value and importance.

Confidence in the crypto sector is, therefore, linked closely to trust in crypto exchanges themselves. The sector’s future prospects will depend on an ecosystem of exchanges that remains fast-paced and innovative while commanding the trust of those who use them. Financial regulation is much discussed as having a role to play; for example, with licensing regimes. Debate rages about the merits and demerits of such regulation, and whether it will help the crypto sector mature, stifle its creativity, or both. What is clear, though, is that regulation is becoming a fact of life.

But financial rulemaking is not the only regulatory challenge that the sector will have to address. It is only a matter of time before antitrust scrutiny occurs, driven by (i) the nature of competition among crypto exchanges; (ii) the prospect of a ‘winner takes all’ market; (iii) the separation of leading exchanges from the rest of the pack; (iv) commercial factors driving high-value M&A; and (v) antitrust’s treatment of traditional financial exchanges.

Well-designed competition policy can support crypto’s development, acting as a critical friend rather than holding it back. Achieving this goal will require early engagement from antitrust agencies and crypto exchanges, the use of competition advocacy tools, and a full understanding of the technical and commercial context in which crypto exchanges’ mergers or practices occur. It will be a bumpy, high-speed, but ultimately worthwhile ride. Antitrust agencies and crypto exchanges would be well advised to ‘hodl’. [1]

A brief primer: how cryptocurrencies work

Most transfers of money in dollars, euros, sterling, or other fiat currencies no longer involve transfers of physical cash. Rather, once a transaction has been verified – essentially, checking that the payor has sufficient funds to make the payment – the transaction is reflected in ledgers that the payor’s and payee’s banks maintain. These ledgers are akin to large spreadsheets and record the amount of money in each party’s bank accounts. If Mr Smith pays Ms Jones £100, their banks update their respective ledgers to show that Mr Smith’s account now holds £100 less and Ms Jones’ account holds £100 more. In other words, payments are made by banks changing numbers in ledgers; not moving physical cash. Since these ledgers are maintained by one or a small number of intermediaries (i.e., banks), they are described as being ‘centralised’.

Cryptocurrencies are digital currencies. Users can transfer ‘coins’ to each other that perform the same or similar roles as traditional fiat currencies: storing value and serving as a medium of exchange. As with fiat currency, cryptocurrencies also rely on ledgers to record how much each participant has in their wallet. Take Bitcoin as an example. When Mr Smith pays Ms Jones 100 bitcoins, the ledgers update to reflect the fact that he now has 100 fewer bitcoins in his wallet, and she has 100 more. But instead of relying on banks to verify the transaction and reflect it on centralized ledgers, cryptocurrencies use a technology known as ‘blockchain’ to produce a public ledger. This ‘decentralized’ ledger is a publicly available list of transactions that record each instance of a person sending or receiving a given cryptocurrency, relying on thousands of parties who dedicate time and computing power to keep the ledger secure and up-to-date.

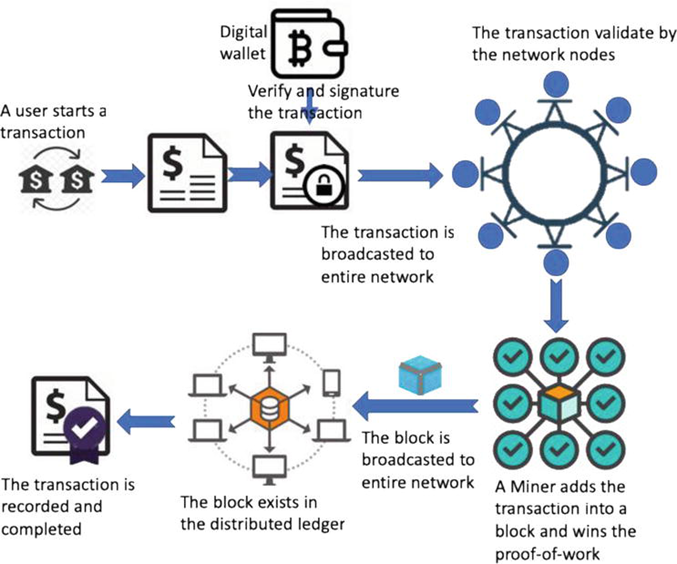

The process works as follows [2]:

- Users have wallets where they store their cryptocurrencies. Each wallet has a public key (similar to a bank account number and sort code) and a private key (similar to a pin number, biometric data, or other means of authenticating a transaction). To continue with our earlier example, for Mr Smith to send Ms Jones 100 bitcoins, he needs Ms Jones’ public key – effectively her wallet’s ‘address’. He will also need to enter his own private key in order to ‘sign’ (e., approve) the transaction.

- The blockchain network is made up of thousands of ‘nodes’ – computers that each store a copy of the public ledger recording how many units of a cryptocurrency each person has, and what transactions have taken place. When two people want to enter a crypto transaction, the proposed transaction is broadcast to these nodes, who check it against the public ledger. In this case, the nodes check that Mr Smith has the 100 bitcoins that he wants to pay Ms Jones. Once satisfied, the nodes approve the transaction and mark it as pending.

- A subset of the nodes – known as ‘miners’ – confirm the transaction and implement it on the public ledger. They do this by batching up pending transactions into ‘blocks’, encrypting them, and adding the blocks to the ledger. Each block of transactions is added sequentially after the previous one. Hence, the system ends up with blocks in a chain, or ‘blockchain’. Current estimates are that a new block is added to the Bitcoin ledger every 10 minutes. [3]

- Once transactions have been batched up into blocks and encrypted, they can be reflected in the public ledger. The transaction is then completed. Jones receives her 100 bitcoin from Mr Smith. Once added to the ledger, transactions cannot be reversed, undone, or rewritten. They are immutable.

Since public ledgers are maintained and secured by countless nodes, they are referred to as ‘distributed’ or ‘decentralised’, in contrast to the ‘centralised’ ledgers that banks maintain for traditional payments in fiat currency. Running a ‘decentralised’ system requires safeguards to ensure that no single party establishes control of the process or becomes a dominant intermediary. Safeguards are needed to avoid a single player manipulating the blockchain – for example, by entering fake transactions or refusing to implement legitimate ones. Bitcoin solves this problem by demanding that miners demonstrate ‘proof of work’ before they can start batching transactions and adding blocks to the chain. This process involves the following steps, as shown in Figure 1:

- The blockchain sets miners challenges that require a large amount of computing power to solve. These challenges have been likened to a lottery, where the greater a miner’s computing power is, the more likely they are to win. In other words, adding more computing power is like buying more lottery tickets – it improves your chances of winning, but victory is never guaranteed. The winner of each round gets the right to batch up, encrypt and add a particular batch of transactions to the blockchain.

- This costly process makes it uneconomical for someone to become a miner merely in the hope of adding fraudulent transactions to the system. As more players enter and compete in the mining process, the cost of mining increases. Mines today can involve warehouses filled with rows of specially designed mining computers, typically in locations that have access to cheap energy and are backed by financial consortia. In this way, ‘mining’ or ‘proof of work’ supports the integrity of the blockchain as a whole. [3] Moreover, if a bad actor did perpetrate a fraud, it would quickly become apparent, destroying confidence in the currency and crashing its value. The exercise of defrauding the blockchain would therefore be futile.

- Miners are not (purely) altruistic. They undertake the cost of mining because the ‘winner’ of each round is rewarded with a predetermined amount of cryptocurrency. At the same time, to control currency inflation, the Bitcoin blockchain is programmed to halve the amount of Bitcoin that is paid out to winning miners every four years. (To keep miners incentivised as the newly minted Bitcoins per block decreases, miners also get paid transaction fees for supporting Bitcoin transactions.)

Figure 1: Simplified representation of how a cryptocurrency transaction works

Through their decentralized design, cryptocurrencies aim to better meet the needs of consumers compared to traditional financial institutions, offering an alternative to banks and other intermediaries. The simple intuition underlying cryptocurrency is set out at the start of the original Bitcoin white paper:

“Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model. Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small casual transactions, and there is a broader cost in the loss of ability to make non-reversible payments for non-reversible services. With the possibility of reversal, the need for trust spreads. Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person by using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party.

What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers”.

In line with the white paper, there are at least six benefits that cryptocurrencies aim to offer compared to traditional payment systems based on fiat currency.

- First, cryptocurrencies aim to lower the cost of transactions. Transactions that use traditional banking rails rely on a range of intermediaries who need to be compensated for their work. A single transaction may require input from the payor’s bank, the payee’s bank, a payment processor, and a card network, among others. Cross-border remittances – often sent by low-earning workers to their families in some of the world’s poorest countries – are a case in point. A recent IMF working paper found that remittance fees in certain ‘corridors’ were as high as approximately 25%, far above the 3% level set out in the United Nations’ Sustainable Development Goals.

- Second, cryptocurrencies aim to promote users’ privacy. Whereas banks, governments, and other intermediaries have oversight of traditional financial transactions, payors might not want to broadcast precisely how they spend their money. Oversight may be legitimate in some circumstances (for example, to identify payments to terrorist organisations), but in other cases, it can serve as a tool of repression. A Russian user donating relief funds to Ukraine might have well-founded fears of a visit from the FSB.

- Third, crypto aims to hand users control of their payments and counteract financial censorship. Banks and other traditional intermediaries may be able to frustrate payments by refusing to implement them, thereby limiting how individuals can spend their money. Again, there can be legitimate reasons for refusal, such as compliance with trade sanctions. On the other hand, refusing to implement payments to legal but unpopular causes might be said to undermine freedom of speech.

- Fourth, a large proportion (c.24%) of the world’s population has no access to traditional banking services. Cryptocurrencies provide a potential opportunity for these ‘unbanked’ consumers to store and transfer currency, even without having a bank account. All they need is an Internet connection. Thus, cryptocurrencies have achieved high penetration in countries where access to – or trust in – traditional banking is low.

- Fifth, cryptocurrencies can have built-in mechanisms to control the money supply, with the aim of protecting the value of individual coins over the long term. They can be designed with a range of policies regarding minting new coins, from very strict and clearly-defined structures, as in Bitcoin, to flexible structures that include elements akin to the governance exercised over central bank currencies or share issuances.

- Sixth, the process of transferring cryptocurrencies is secure by virtue of being decentralized. To date, the Bitcoin blockchain has never successfully been hacked. And proof of work provides a strong safeguard against fraudulent transactions, as explained above.

All of these goals rely on individual users being able to buy, sell, and trade cryptocurrencies, including converting cryptocurrencies to fiat currencies (and vice versa). That is where crypto exchanges come in.

Crypto exchanges compete on several parameters, including liquidity and security

There are several ways for trading in cryptocurrencies to occur:

Centralized crypto exchanges are marketplaces that enable large numbers of users to buy and sell cryptocurrencies. These exchanges typically announce trading prices, while professional traders may also decide to purchase feeds of trading data from specialized services. Centralized exchanges charge a commission for trades that occur between buyers and sellers on their platforms, among other revenue streams, and may offer users a place to store cryptocurrencies that they buy and sell. [4]

Decentralized exchanges (or ‘DEXs’) aim to solve the problem that ‘longtail’ cryptocurrencies may struggle to find pairs of buyers and sellers who are willing to trade in those particular coins or tokens. Rather than using a central intermediary or market maker, DEXs create ‘automated market makers’ through pools of coins or tokens (‘liquidity pools’) that always offer trades in the specified longtail coins or tokens. Using smart contracts and bonding curve algorithms to establish and adjust prices, these pools provide a constant source of liquidity. Investors contribute crypto assets to liquidity pools, which are used to clear ‘buy’ or ‘sell’ orders, generating a return by taking a share of transaction fees. Investors can decide freely what level of contribution to make, receiving a stake in the pool – and a share of fees – corresponding to their contribution.

Crypto brokerages sell cryptocurrencies to users at fixed prices that the brokers set. In other words, whereas transactions on exchanges take place between users, on a brokerage site the user transacts with the broker. Certain payment platforms partner with brokers to let their users access cryptocurrencies with ease – a recent example, is the partnership between PayPal and Paxos. Crypto brokerages have been characterized as better suited for users who are new to cryptocurrencies, but less suitable for longer-term or more experienced investors since they are more costly to use than exchanges.

Crypto derivative exchanges enable traders to buy and sell futures contracts and options in cryptocurrencies. These include a range of exchanges, from established crypto exchanges such as Binance to specialized players who offer derivatives-only platforms, such as Bybit.

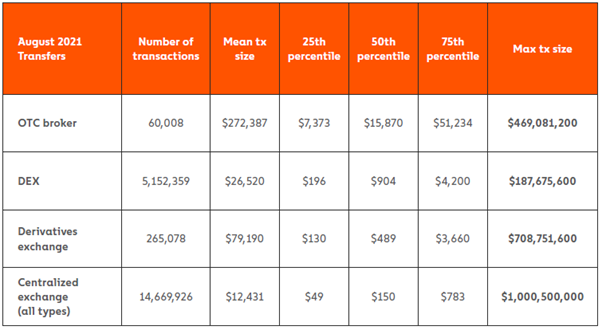

These categories are not always clear-cut and can overlap. Several exchanges operate venues facilitating trading in both cryptocurrencies as well as crypto derivatives (eg Binance, Coinbase). There are also connections between centralized exchanges and DEXs (for example, the Coinbase Wallet can be used to trade via DEXs alongside Coinbase). Among the various options, centralized exchanges are believed to have the largest volume of transactions, but with a lower average transaction size (see Figure 2).

Figure 2: Volume and value of crypto trading venues by type

Centralized crypto exchanges compete along several parameters, including liquidity, reputation, cost of trading, range of coins, and marketing.

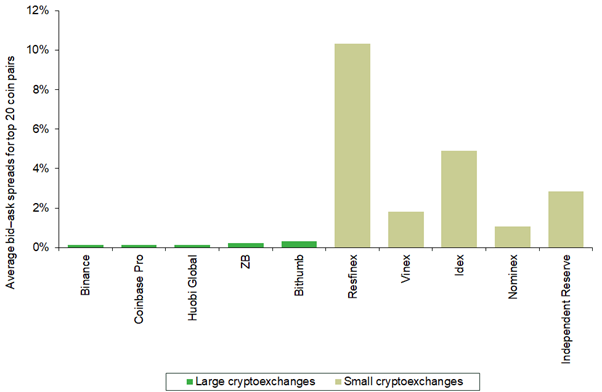

Liquidity. As with any exchange or marketplace, users want a venue where there are lots of other traders looking to buy and sell. In other words, the more people trade on a particular exchange, the greater the opportunities that exchange offers to enter into mutually-beneficial trades. Users seek out ‘thick’ or ‘liquid’ markets. Liquidity can be quantified through a ‘bid-ask spread’ (i.e., the difference between the price that the buyer is willing to pay and the price at which the seller is willing to sell). A small spread suggests a liquid market with enough buyers and sellers to enable trades to occur at prices that buyers and sellers accept. A large spread suggests the opposite. As Figure 3 shows, bid-ask spreads are substantially lower on larger crypto exchanges compared to smaller ones.

Figure 3: Bid-ask spreads of coin pairs on crypto exchanges

Security/Reputation. The early history of crypto exchanges was not a happy one: the first crypto exchange, Mt. Gox, was hacked, lost crypto assets, and its executives faced criminal charges. The press asked whether its failure might even “bring down” Bitcoin itself. This experience – together with nervousness around new and complex currencies – has led to investors gravitating towards exchanges believed to represent the most ‘stable’ or ‘secure’ players. Crypto exchanges have therefore sought to prove their credibility by emphasizing how they protect users’ assets. Some have taken on large insurance policies – a fact that they advertise to the public at large. Others market themselves on the basis of their investment in high levels of cybersecurity.

Cost of trading. Fees for trading on crypto exchanges can include (i) trading fees, typically structured as a percentage of the value of the trade; (ii) deposit or withdrawal fees (also known as ‘funding fees’) which some exchanges charge for moving money into or out of a user’s account on the exchange; and (iii) interest/borrowing/liquidation fees that some exchanges charge in return for lending funds for users to engage in margin trading. Different exchanges charge different fees: for example, as industry comparison tools note, “trading fees vary by more than an order of magnitude, from 0.1% to more than 1% on Coinbase and Gemini”. As with any other sector, reducing fees is an important way that crypto exchanges compete.

Range of coins and tokens. There are estimated to be thousands of different cryptocurrencies now in existence. How many coins an exchange offers raises tension in how it is perceived by users. On the one hand, offering a wide selection of coins gives traders more choice and many bring more users to the platform, in turn increasing liquidity. On the one hand, exchanges have an interest in filtering out coins that are not credible or may be propagated by malicious actors, thereby affecting user trust in the exchange itself. Exchanges may manage this tension by having objective criteria for any cryptocurrency to meet before it can be admitted. As noted above, listing tokenized versions of other (non-cryptocurrency) assets is expected to be an important future use case. The first such examples are already emerging – FTX users can trade tokenized versions of stocks in Tesla. As more come to market, exchanges may have to compete to secure (exclusive) listings for high-value tokenized assets. It is unclear whether those tokenized assets will ultimately be listed across multiple exchanges, like cryptocurrencies, or concentrated on individual exchanges.

Marketing. In a young, dynamic and crowded sector, marketing can play an important role in bringing traders to a particular platform. Crypto.com created a commercial starring Matt Damon and has entered sponsorship deals ranging from the Staples Center in Los Angeles to Formula One races and the UFC, while Coinbase has entered a sponsorship arrangement with the National Basketball Association. Regulatory limits on marketing may, however, be on the horizon. The UK Financial Conduct Authority (FCA) is consulting on tighter rules in response to concerns that crypto adverts were failing to make consumers aware of the risks. Specifically, the FCA is considering requiring unauthorised persons’ marketing to be approved by FCA-authorised persons who have sufficient expertise in the sector to which the promoted products relate. In practice, this could mean that FCA-authorised crypto firms will be in charge of deciding whether to allow marketing by non-authorised persons to go ahead. This raises the prospect of authorised firms refusing to approve marketing by their rivals.

Price, product range, and marketing are typical parameters of competition, in no way unique to the crypto sector. Competition on liquidity and security is less common and raises questions about the tendency of the sector to concentrate, with traders ‘crowding in’ to a small number of exchanges that offer the narrowest bid-ask spreads, and which are perceived as being the best-established and most secure. These considerations could strengthen the network effects that characterize financial exchanges, potentially leading to concentration.

______________

[1] Kraken: “Hodl: verb (used with cryptocurrency), hodl·ing […] HODL is sometimes described as an acronym for “hold on for dear life”. While this is not how the term originated, this explanation does a good job of capturing the essence of the phrase’s meaning”.

[2] For simplicity, this description considers systems using ‘proof of work’. Other systems, such as ‘proof of stake’, exist too, but are not described here.

[3] This occurs by design: the Bitcoin blockchain adjusts the difficulty of the task that miners are asked to solve in order to avoid blocks being added more quickly.

[4] Having set up an account with an exchange or a broker, users typically receive a ‘hosted’ wallet, which sits within the exchange or broker’s platform. Users can generally (but not always) transfer their cryptocurrency from this ‘hosted’ wallet to a ‘non-custodial’ personal wallet. Personal wallets can be ‘hot’ (i.e., hosted in third-party software and connected to the Internet) or ‘cold’ (i.e., sitting within a physical device that is not connected to the Internet, and is therefore particularly secure against hacks). Users can transfer cryptocurrency from their wallets to those of other users, provided they have the recipient’s public key, as described above.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.