Introduction

If we are to summarise competition law developments of Turkey for 2022 in a few headlines, these would include the amendments to the merger control thresholds, the exceptions introduced for the technology undertakings with a view to catching killer acquisitions, the increased scrutiny over online platforms, the closer relationship between competition law and data, the prevention of data portability being considered as an abusive behaviour, the investigations over companies’ activities on human resources, the increased fines imposed upon hindrance of on-site inspections, the case-law requiring the Turkish Competition Authority (“TCA”) to follow a higher standard of the proof scheme and the first examples of settlement procedures.

First, 2022 brought significant merger control changes. These include an amendment to the turnover thresholds and the introduction of an exception for the mergers in the technology field, in a sort of a Turkish “value of transaction” test to address the killer acquisitions.

Data, online platforms, online markets, data portability, and access to data during on-site inspections were among the concepts under the spotlight of the TCA. The TCA acknowledged the importance of data and data portability for online platforms, as well as the key position of these concepts from the perspective of competition law. At the same time, we witnessed that the existence or even absence of certain data could serve as evidence of a competition law violation. Several cases of the hindrance of on-site inspections due to the deletion of messages on WhatsApp and/or providing delayed access to information deserve special attention here.

Another prominent case law this year was the TCA categorising wage-fixing and no-poaching agreements as no different than cartel agreements. TCA had a few decisions on wage-fixing and no-poaching agreements over the years, which concerned container transportation, TV series production, and private school sectors. However, Private Hospitals Cartel case now sets the standards as per the competition law enforcement in the labour markets.

Finally, this year, the TCA concluded several investigations through the settlement procedure, including one case which involved a leniency application. In this case, the undertakings that decided to settle obtained reductions of up to 25%. These examples serve as an encouragement for the undertakings to settle with the TCA, i.e., to save time and money for all.

Changes to competition laws and policies

2022 brought significant changes to the Turkish merger control regime. The TCA amended its merger control legislation through Communiqué 2010/04 with effect from 4 May 2022. The applicable thresholds were substantially increased as a response to the fluctuations in the value of the Turkish Lira.

Pursuant to the newly introduced amendments, a concentration shall be deemed notifiable in Turkey if: (i) the aggregate Turkish turnover of the transaction parties exceeding TRY 750 million (approx. EUR 43.2 million or USD 45.3 million) and the Turkish turnover of at least two of the transaction parties each exceeding TRY 250 million (approx. EUR 14.4 million or USD 15.1 million), or (ii) the asset or business in acquisition transactions, and at least one of the parties of the transaction in merger transactions, have a turnover in Turkey exceeding TRY 250 million (approx. EUR 14.4 million or USD 15.1 million) and the other party of the transactions has a global turnover exceeding TRY three billion (approx. EUR 172.6 million or USD 181.2 million). [1]

Another important amendment encompasses an exception brought for concentrations involving “technology undertakings”. Transactions regarding the acquisition of technology undertakings operating in the Turkish geographical market or having R&D activities or providing services to users in Turkey shall be subject to notification to the TCA regardless of the abovementioned TRY 250 million turnover thresholds.

The rationale behind this change is to enable the TCA to address potential concerns associated with mergers targeting newly established and emerging technology undertakings (not necessarily generating a considerable turnover). Different from the “transaction value test” adopted by peers in the EU, Germany and Austria, the TCA has chosen a broader approach to tackle the relevant transactions. In that regard, one part of the turnover threshold test shall not be sought for transactions having as target technology undertakings, which either operate or conduct R&D activities in the Turkish market, or alternatively provide services to Turkish users.

As the currency exchange tool, the TCA uses the Central Bank of Turkey’s average buying exchange rate realised in the previous year. So, although the thresholds were increased in May 2022, the TCA has continued to calculate the foreign currencies based on 2021’s average rate.

As of 2023, the thresholds will be calculated based on the Central Bank of Turkey’s average buying exchange rate for 2022. This means that, while assessing if a transaction falls into the notification necessity, the exchange rate to be used, speaking for Euros will be 17.38, whereas the same was 10.47 while assessing transactions in 2022. For USD, the exchange rate was 8.89 in 2021 and the same is 16.56 in 2022. This alone shows that the TCA will be much busier with merger reviews in 2023. On the other hand, the recent exception for the technology markets will also lead the TCA to have an increased review workload for transactions involving a technology dimension.

Also, considering the evolving landscape of regulations on digital platforms, in 2022, TCA opened the Draft Amendment on Competition Law (“Draft Amendment”) for consultation as of the first half of October. The Draft Amendment resembles the recent regulatory efforts in Europe, especially the Digital Markets Act by the European Union. The Draft Amendment introduces new concepts, the most significant being “undertaking holding significant market power”. Contemplating obligations for these undertakings, the TCA signals that it will continue to meticulously look into digital platforms (for more detailed information, see here).

Enforcement of competition law and policies

Examples of decisions for anti-competitive practices, including agreements and abuse of dominant position

Although there was a great number of cases in 2022, we would like to touch upon the ones that stand out from the crowd due to their multidisciplinary perspective, such as handling issues that fall both under competition law and IP, competition law and labour markets, competition law and data.

The first example in that regard is the Nadir Kitap case (Case 22-16/273-122). It is about the abuse of dominance by an intermediary platform which sells second-hand books. Nadir Kitap was fined for abusing its dominance by restricting data portability to other bookselling platforms. The case is prominent as it relates both to Law No. 4054 on the Protection of Competition (“Turkish Competition Law”) and Law No. 5846 on Intellectual and Artistic Works. The TCA here concluded that there is no conflict between IP law and competition law as they share the same goal.

The TCA concluded that restrictions on data portability by a dominant undertaking shall be viewed as an abuse of dominance due to creating entry barriers. The TCA assessed that by refusing to share inventory data, Nadir Kitap had (i) blocked sellers from transferring data to its competitors, (ii) restricted the transfer by adding its own logo to the photos of the books, and (iii) stated that it was illegal to transfer these images to other platforms. Moreover, it was determined that Nadir Kitap had suspended memberships of data-sharing sellers and thus, ensured sellers to stop sales through competing undertakings, hereby restricting competition.

Further to the administrative fine, the TCA ordered Nadir Kitap to provide to the sellers (members) upon their request, the book inventory data in an accurate, understandable, secure, complete, accessible, free of charge and appropriate manner. The main takeaway of the case is that prevention of data portability can be considered abusive behaviour. Restricting such portability can create burdensome and artificial transition costs for the data owners, and hence constitute an entry barrier.

Private Hospitals Cartel case (Case 22-10/152-62) is the first decision in which the TCA imposed fines on undertakings for their actions in the labour market. The TCA imposed a total of TRY 58 million (approximately EUR 7.2 million) in administrative fines on undertakings, based on their 2020 turnover.

In this decision, the TCA identified two types of violation: exchange of information and wage-fixing. Private hospitals had jointly determined the operating room service fees for freelance physicians. They have fixed the wages through agreements and been involved in no-poaching through to a gentleman’s agreement aimed at preventing the transfer of physicians (as well as nurses).

Interesting to see the TCA’s assessment here in relation to the no-poaching agreements – the investigation proved that there were limited transfers of physicians between the hospitals concerned and circulation numbers were much higher between other hospitals. Additionally, the per se violation of the no-poaching agreements was emphasized in justifying that there was no need to further assess the effects of such agreements.

All in all, the TCA stated that agreements to fix the salaries of employees and no-poaching agreements, which constituted the main part of competition law enforcement in labour markets, were not different from cartels. The TCA determined that (i) no-poaching agreements were similar to customer/market-sharing agreements, and (ii) wage-fixing agreements were similar to price-fixing agreements. It was determined that these practices restricted the competition per se.

Despite being a 2021 decision, the TCA’s ruling on Modanisa case (Case 21-57/789-389) that was published in 2022 is of particular importance in terms of clarifying the types of non-advertising agreements that can benefit from trademark protection. The TCA had dealt with a request from Modanisa for negative clearance (and individual exemption) for the “negative matching obligation” stipulated in an agreement between two undertakings active in the sale of ready-to-wear clothing for women: Modanisa and Sefamerve have agreed to recognize each other’s trademarks and their derivatives, with a view to avoiding confusion in advertisements and announcements to be placed on the internet.

With regard to the negative clearance, the TCA stated that although the narrow non-brand bidding restriction could fall in the scope of the trademark protection, wide non-brand bidding agreements and negative matching obligations would exceed the scope of the trademark protection granted by intellectual property law. The TCA concluded that a negative clearance could not be granted since the agreement might have a restricting effect on competition.

As for the individual exemption review, the TCA took a similar approach and indicated that the undertakings’ agreement on not using each other’s registered brands in their advertisements would be sufficient to prevent the consumers from being misled. Restrictive obligations beyond this would not provide an additional benefit to the consumers, but on the contrary, could harm the consumers by reducing the visibility of advertisers and the competition between undertakings. Therefore, the TCA did not grant individual exemption until the scope of the agreement is narrowed to match the exact boundaries of the registered trademarks, and the negative matching obligation are removed.

Another noteworthy TCA decision in 2022 regarded the “Circle of Five” investigation (Case 22-06/83-34). The TCA’s investigation was triggered by the leniency application made by Daimler before the EC that ultimately resulted in EC’s Car Emissions Cartel decision (Case AT.40178 – Car Emissions).

The TCA investigated Audi AG, Bayerische Motoren Werke AG, Daimler AG, Dr. Ing. h.c. F. Porsche AG and Volkswagen AG, referred to as the “Circle of Five”, to see whether these companies have violated the Turkish Competition Law by means of coordinating aspects of their businesses such as product features, innovation, environmental and security technologies, certificates, and standards including component development and manufacturing, exhaust treatment and emission standards. The most notable part of this case is that, although EC has fined some aspects of the cooperation among the investigated undertakings, the TCA found out that there hasn’t been a jurisdictional effect that fulfilled the criteria of being “direct, significant and reasonably predictable/intentional” in the Turkish market. In that respect, the investigation was finalised without fines.

The final important decision on anti-competitive practices in 2022 concerned fast-moving consumer goods. The first investigation in this field was concluded back in 2021 with significant fines (approximately TRY 2.7 billion) imposed on five supermarket chains and one supplier due to a hub-and-spoke (Case 21-53/747-360). The second investigation which was a follow-up was finalised on the last days of 2022. Although the reasoned decision is not yet published, it is expected to be one of the milestones of hub-and-spoke cartels.

Examples of decisions concluded through the settlement procedure

In 2022, the TCA concluded a total of 29 investigations, 12 of which were concluded under the settlement procedure. The settlement procedure entered into force in 2020 and the first implementation was seen in August 2021. By the end of 2021, there were 3 investigations concluded with a settlement. The numbers show that the procedure is getting more use over time.

For example, in Singer case (Case 21-42/614-301), the company was investigated upon allegations of violating the Turkish Competition Law through RPM, restriction of online sales, and de facto exclusivity in the supply of sewing machines. Singer monitored the online prices of its sales points. Those that sold at prices under the recommended price were subject to pressure and sanctions, i.e., removing discounts or not supplying products. There was no collective ban from Singer on dealers operating on sales platforms, so online sales could be made. But Singer made great efforts to set and control sales prices in online channels and interfered with resale prices.

Although the TCA did not make a clear statement that Singer was in a dominant position, it was emphasized that Singer held significant market power; it was difficult for dealers to deviate from the resale prices determined by Singer. During the investigation, Singer made both commitment and settlement applications. The TCA stated that since the resale price determination practices constitute hardcore infringements, no commitment application could be made. So, the TCA evaluated the case within the scope of the settlement procedure. Consequently, the TCA decided to conclude the investigation with a settlement. While Singer agreed to remove the non-compete clause from its dealership agreements, the administrative fine was reduced by 25%.[2]

In 2022, the TCA has for the first time reviewed leniency along with a settlement application. This was within the scope of the investigation concerning whether Beypazarı and Kınık had violated Article 4 of the Turkish Competition Law by way of exchanging information regarding current and future prices, and price transition dates for natural mineral water. Beypazarı and Kınık individually submitted their settlement applications. The TCA reviewed and accepted both settlement applications and implemented a 25% reduction over the applicable administrative fines (Cases 22-17/283-128 and 22-23/379-158). In addition, as Beypazarı and Kınık have also applied for active cooperation, within the scope of the Regulation on Active Cooperation for Detecting Cartels, the companies respectively received 30% and 35% reductions over the applicable fines.

Significant cases – examples of the hindrance of on-site inspections and standard of proof

During on-site inspections, the TCA is entitled to examine all data and documents of the company, including those on electronic platforms and information systems, such as servers, mobile devices and chatting applications in line with its Guidelines on the Examination of Digital Data during On-Site Inspections. The scope of inspection also covers personal devices (mobile phones, tablets, etc.) if they contain any data or correspondence relating to the company. Practice shows that the TCA follows a rather strict approach, particularly in the circumstances such as data deletion. These instances can be qualified as hindrances or complications of the on-site inspection. The TCA did not consider privacy concerns or claim that deletion only concerned personal data as valid grounds. The TCA rejected these arguments on numerous occasions and was followed by imposing fines on the undertakings concerned.

In the Kınık case (Case 22-11/161-65), the TCA emphasized that the deletion of WhatsApp messages constituted hindering of inspection, even if the data is later retrieved. During the inspection, the TCA officials discovered that some e-mails had been permanently deleted following the start of the inspection. In addition, it was determined by technical reports that the contents of WhatsApp chats with the Chairman of the Board of Directors of a competitor had been deleted while the on-site inspection was pending.

After the inspection, Kınık claimed that they could provide the TCA access to e-mail backup that would allow them to retrieve deleted e-mails. The TCA stated that the deletion would constitute hindering inspection even if the data had been retrieved. In that regard, the company was fined for hindrance of onsite inspection.

In the A-101 case (Case 22-28/464-187), the TCA suspected that the phones of the three employees might have been involved in activities aimed at destroying data. But, as a result of the indexing of the phones of two employees with forensic devices, no deletion log record was identified on WhatsApp. As the third employee’s phone could not be indexed, there was no log record that could help the TCA to identify whether there has been a deletion. Since the TCA officials could not find evidence that could prove the deletion of WhatsApp correspondences, there was no finding of violation, so no fine was imposed. This decision adds a booster point of view to the latest case law (Sahibinden.com case) as it demands a higher standard of proof in favour of the undertaking. Now it is certain that finding of violation for the hindrance of an on-site inspection requires the availability of concrete evidence.

In 2022, there is a particular Council of State decision which reinforces the TCA’s strict position that on-site inspections should be facilitated without delay (Decision of the 13th Chamber of the Council of State dated 22 June 2022 and numbered E:2022/1993, K:2022/2819).

This decision regards the appeal process of the Unilever case (Case 19-38/584-250) adopted upon the company’s hindrance of examination for around seven and half hours without a legal or valid justification. Unilever has taken the decision to appeal. The Regional Administrative Court has stated that the necessity to obtain approval from executives abroad could not be counted as a legally acceptable ground to delay the inspection, considering that the scope of the on-site inspection was Unilever’s organisation in Turkey (Decision of Ankara Regional Administrative Court’s 8th Administrative Chamber dated 10 February 2022 and numbered E:2021/1523, K:2022/222).

Moreover, obtaining permission from directors abroad was a matter of determination and distribution of duties, authorities, and responsibilities in Unilever’s own internal functioning.

The Regional Administrative Court stated that Unilever, which operates subject to the applicable Turkish laws, should have known how to run its business in a prudent manner. So, the Court rejected the appeal and approved that the examination was hindered by Unilever without a legally acceptable or valid justification. In addition, the Regional Administrative Court emphasized the importance of time sensitivity, referring to the Council of State’s decision stating that even a 40-minute delay constitutes a hindrance or complication of an on-site inspection (Decision of the 13th Chamber of the Council of State dated 22 March 2016 and numbered E:2011/2660, K:2016/775).

Subsequently, the Council of State this year, rejected the appeal request and approved the decision of the administrative court. Thus, the TCA’s point that inspections should be facilitated without delay was reinforced.

Court decisions underline the importance of the standard of proof

This year, we have seen two court decisions, each overturning the TCA decisions on the same grounds: the standard of proof. From a historical point, these decisions are significant since they are the first annulled cartel decisions in the history of Turkish Competition Law. They are also of a guiding nature in that courts expect the TCA decisions to meet the standard of proof criteria.

The first one regards the TCA’s decision on the investigation regarding companies active in chemical products for water treatment plants. Under this decision, the TCA has concluded that the companies have violated Article 4 of the Competition Law through price fixing (Case 20-50/693-304). The basis for the finding was an internal correspondence between the investigated Akkim’s employees, which included explanations on the determination of approximate cost amounts about a tender. TCA also alleged that Akkim had held meetings with Hicri Ercili (the other investigated company) at different times, which indicated the existence of meetings held in the past years and that Akkim was in anti-competitive collusion with Hicri Ercili. Akkim took the case to the court and the Administrative Court ruled that the TCA’s decision did not meet the standards of proof for price collusion (Decision of Ankara Regional Administrative Court’s 8th Administrative Chamber dated 15 June 2022 and numbered E:2021/1567, K:2022/1318).

The Court concluded that there is no proof of collusion on prices establishing that the meetings are only related to raw materials trade between Hicri Ercili and Akkim as Hicri Ercili is also a supplier of Akkim. Since there is no communication between the parties on prices, the Court established that the Competition Authority erred in law in holding that the Parties colluded to increase the prices in the market.

The other decision regards the TCA’s cartel finding on the MDF and Flakeboard markets, where the TCA has fined 11 companies (Case 21-18/229-96). As for the basis for the violation, the TCA pointed out to the MDF and Flakeboard Industry Association meetings where the undertakings have allegedly engaged in an agreement/concerted practice to determine the percentages and timing of the price increases.

Although the meeting minutes had shown that one of the companies (Kronospan) had not attended the meeting, the TCA ruled that Kronospan had been a member of the cartel. The Administrative Court found that even though Kronospan had increased the prices of the products at the same or similar rates, it did not attend the alleged meetings and its pricing movements had occurred far later than the other undertakings, thus ruled that the TCA’s decision did not meet the standards of proof for confirming the allegations against Kronospan and annulled the TCA’s decision.[4]

Mergers and Acquisitions – Cases on Technology Undertakings in the focus

Following the introduction of the exception for the technology undertakings that came into force in May 2022, the TCA provided guidance via its decisions on the boundaries of the definition of technology undertaking. Technology undertakings are defined in the regime as undertakings or related assets operating in the fields of digital platforms, software and gaming software, financial technologies, biotechnology, pharmacology, agrochemicals, and health technology.

One of the first implementations of the technology exception was in Citrix/TIBCO/Vista Equity Partners Management case (Case 22-21/344-149). Considering that the concentration involved technology markets (transaction parties were active in the development of the software), the TCA did not test if the target had a turnover exceeding TRY 250 million. In Providence/Airties case (Case 22-25/403-167), a provider of Wi-Fi solutions and software services that enable broadband operators to deliver and manage Wi-Fi networks to residential customers was considered as a technology undertaking. In Google/Mandiant case (Case 22-26/425-174), the TCA evaluated Google’s acquisition of sole control over Madiant. As Mandiant is a cyber security company, it is considered a technology undertaking operating in the field of software. Therefore, the TCA decided that the transaction should be evaluated under the relevant exception.

Sales of diagnostic imaging devices were also viewed as activities in the biotechnology sector according to Groupe Bruxelles/Affidea case (Case 22-27/431-176). In Astorg/Corden case (Case 22-25/398-164), the Corden Pharma Group produced application programming interfaces and ready-to-use pharmaceuticals. As the target’s activities fell within the pharmacology sector, turnover of the target was not sought.

However, the determination of technology undertaking was not always straightforward. In Cinven Capital/International Financial case (Case 22-23/372-157), the company was viewed as a technology undertaking since it provided a small number of its customers with digital access via digital platforms in the life insurance sector in Turkey. [3]

The main takeaway here is that a company could be considered a technology undertaking within the sense of the merger control regime, if it is active in the software market by way of utilising technological tools, such as digital platforms, in providing its services.

In Nielsen/Brookfield case (Case 22-24/395-BD), there is a slightly different approach. Unlike Cinven Capital/International Financial, the TCA here found that using the software as a tool in providing services could not be considered the only proof to demonstrate that a company is active in the technology markets. Even though it utilised data analytics tools to provide its customers meaningful insights about market conditions and consumer trends, Nielsen was not considered a technology undertaking. Hence, the transaction was determined not to fall within the scope of the exception.

In CD&R-TPG/Covetrus case (Case 22-27/431-176), concerning the acquisition of joint control over Covetrus Inc., given that the activities of Covetrus are in the pharmaceuticals for animals and software sector, the TCA evaluated Covetrus’ activities to be within the scope of “health technology” and “pharmacology,” and therefore, the thresholds of the parties would be subject to the exception. It is interesting to observe that, although it produces software, the TCA did not consider Covertus as a software company but rather concluded that it “may” be in the health technology or pharmacology sectors.

The concept of the technology undertaking still lacks clarity. Precedents in this area will help the players to develop a better understanding and assessment, therefore leading to better practice. We expect more guidance from the TCA to increase legal certainty under the Turkish merger control regime. Until then, to be on the safer side, we recommend carefully assessing and notifying the transactions that may have a connection to the technology/digital world.

Looking Back at 2022: The TCA’s Decision Statistics

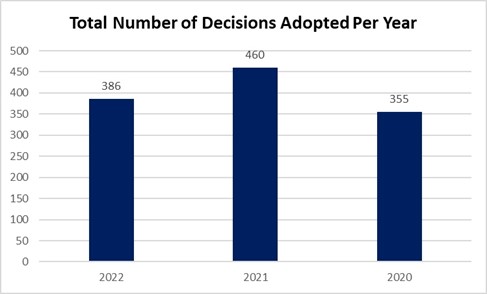

The TCA adopted 386 decisions in 2022. This means a 16% decrease in the total number of decisions compared to 2021. One of the main reasons for this decrease seems to have been a decline in the number of merger notifications reviewed by the TCA. In 2022, the TCA reviewed 245 transactions compared to 309 in 2021.

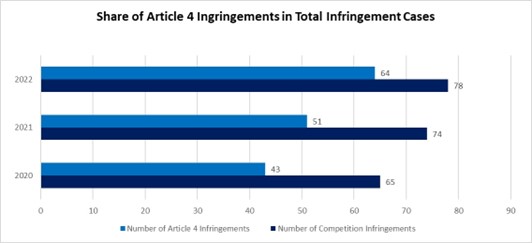

Article 4 of Turkish Competition Law (article on anti-competitive agreements) again had the largest share as the main area of focus in the competition infringement decisions of 2022, similar to 2021. In 2022, 82% of the total 78 infringement decisions were based on Article 4 of Turkish Competition Law, compared to 69% in 2021 and 66% in 2020.

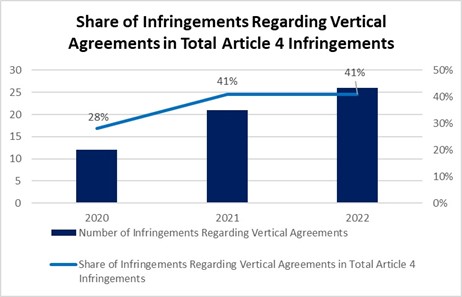

Cases on vertical agreements account for an important part of the total infringement decisions concerning Article 4 of Turkish Competition Law. In 2022, the TCA issued 26 infringement decisions regarding vertical agreements (41% of the infringement decisions issued under Article 4 in 2022), while this number was 21 in 2021, and 12 in 2020.

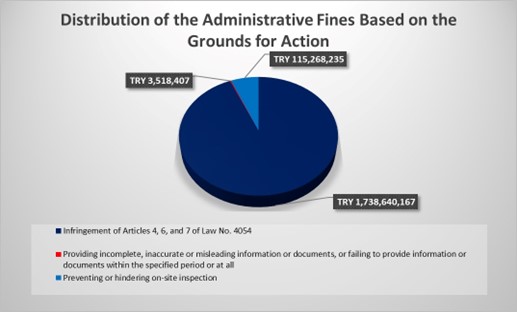

In 2022, the TCA imposed fines amounting to TRY 1.86 billion. Approximately TRY 115 million of the fines were penalties imposed for preventing or hindering on-site inspections. Further, TRY 3 million of fines were imposed for providing incomplete, inaccurate, or misleading information or documents regarding information requests or on-site inspections, or for failing to provide information or documents within the specified period or at all. Similar to 2021, in 2022, the fast-moving consumer goods sector received the highest total administrative fines with TRY 878,650,647.62 as a result of the decision covering hub-and-spoke allegations and resale price maintenance. The relevant investigation is a follow-up of an investigation regarding retail markets concluded with an administrative monetary fine of TRY 2.7 billion in 2021.

Concluding remarks

The competition law and practice in Turkey keep improving. This year has witnessed:

- A substantial increase in the merger thresholds to address the fluctuations in the value of the Turkish Lira against other currencies;

- Introduction of an exception for technology undertakings with a view to catching killer acquisitions in this field;

- Complex cases involving data. In one of the cases, the TCA identified the prevention of data portability as an abuse of dominance;

- Increased scrutiny for potential infringements in the field of human resources;

- Increased number of cases regarding hindrance of on-site inspections and substantial fines upon infringement;

- Efforts to have a well-grounded standard of proof before establishing an infringement, and;

- Settlement procedure having an established implementation.

The TCA acknowledges the necessity to adapt itself to the changing competition landscape, the rise of digital markets and the accompanied complications. In terms of policy adjustments on digitalisation and big data, the TCA follows the footprints of the European Commission through the Draft Amendment.

We also see significant amendments in relation to concentration control, in terms of thresholds and technology undertaking considerations. The latter concept is yet to be developed with more practice from the TCA to create legal certainty.

Like its peers, the TCA handled a number of investigations and cases where data was the centre of discussion. We also saw procedural developments and a more established implementation of the settlement procedure. The TCA has created several cornerstone decisions in terms of human resources, prevention of data portability and hindrance of onsite inspections. We believe these will serve as guides for the companies as well as practitioners.

The TCA’s Decision Statistics for 2022 show that the total number of decisions decreased in comparison to 2021 due to the decline in merger notifications based on the fluctuations in the Turkish Lira. On the other hand, we observe TCA’s scrutiny for vertical infringements. Fast-moving consumer goods are under the spotlight similar to the previous year. The level of fines also proves that TCA is keen to impose deterrent fines, especially in cases of the hindrance of on-site inspections.

As of 2023, the merger thresholds will be calculated based on the Central Bank of the Republic of Turkey’s average buying exchange rate for 2022. This alone signals that the TCA will be much busier with merger reviews this year. On the other hand, the recent exception for the technology markets will also lead the TCA to have an increased review workload for transactions involving a technology dimension. We also expect to see more cases where the data will have a central position.

____________

*Any opinions or conclusions provided in this blog entry shall not be ascribed to ACTECON or any clients of the firm involved in the case.

[1] The amounts in EUR and USD for the 2022 financial year (i.e., 01.01.2022 – 31.12.2022) are converted using the exchange rates respectively EUR 1 = TRY 17.38 and USD 1 = TRY 16.56 in accordance with the applicable Central Bank of the Republic of Turkey average buying rate for 2022 financial year.

[2] Among other examples of concluding the investigations with settlement in 2022 are Arnica Pazarlama A.Ş (setting their dealers’ resale price and restricting the internet sales via e-marketplace platforms through both contracts and de facto applications and introducing restrictions concerning regions or customers); Hayırlı El Kozmetik Pazarlama A.Ş. (RPM), Olka Spor Malzemeleri Ticaret A.Ş. (“Olka”) and Marlin Spor Malzemeleri Ticaret A.Ş. (RPM and online sale restrictions), DyDo Drinco Turkey İçecek Satış and Pazarlama A.Ş. (RPM), etc.

[3] IFGL was active in providing savings and investment products through life insurance packages to individual investors. The company’s Turkish turnover was mainly derived from sales by a third-party distributor since the undertaking did not have any subsidiaries or affiliates in Turkey.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.