In Turkey, a Phase II review takes 228 days on average, almost eight months from the day of merger notification. Although the Turkish Competition Authority (“TCA”) has prohibited only five proposed transactions during its 25-year tenure, both behavioural (11 cases) and structural remedies (15 cases) were imposed.

The TCA conducted merger simulations in four cases, complex geographic market delineations in four different cases and made quantitative dominance analysis in six cases out of the 53 merger reviews, which reached Phase II between 1997 and 2022. In 2022, TCA took three transactions into an in-depth review.

What Is Phase II? Likelihood of the TCA’s Intervention

As in the European Union, mergers, acquisitions, and joint ventures notified to the TCA are subject to final review if prima facie competition concerns arise. The decision on whether to authorise the transaction is made at the end of this in-depth review phase (“Phase II review”). At this stage, the examination turns into a fully-fledged investigation where the TCA can use its extensive powers to obtain data and evidence.

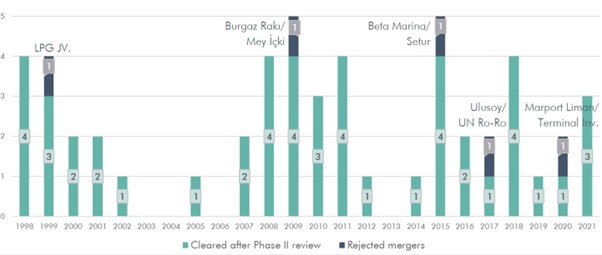

In 25 years, 53 transactions were subject to Phase II review, and five did not receive the necessary authorisation to follow through. These merger decisions are a joint venture in the LPG market (1999), the acquisition of Burgaz Rakı by Mey Alcoholic Beverages (2009), the acquisition of Beta Marina by Setur (2015), the acquisition of Ulusoy Ro-Ro by Un Ro-Ro (2017) and lastly acquisition of Marport by Terminal Inv. (2020).

It is a rare practice for a merger and acquisition transaction to be taken to Phase II. Although a total of 1965 merger applications were evaluated between 2014 and 2023, only 23 have been taken to the second review stage. As a percentage, we can say that the probability of a merger being taken to Phase II is 1%.

Figure 1: A Brief History of TCA’s Phase II Reviews

Duration of the TCA’s Review- Phase I & Phase II

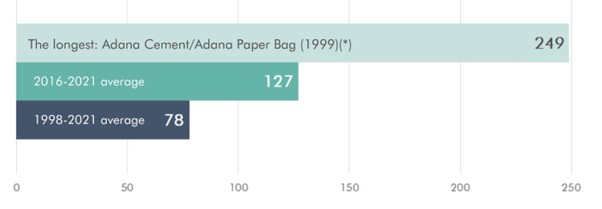

Merger transactions subject to authorisation must either obtain approval or be subject to Phase II review within 15 days from the date of notification. Under Article 11(1) of Communiqué No. 2010/4, for this 15-day period to commence, the TCA requires the “missing” information in the notification form to be completed. Therefore, the period from the initial notification to the decision to take the case to Phase II (i.e., Phase I) is much longer than 15 days. Phase I of a notification that was taken to the final examination lasted 78 days on average. In the last five years, this duration increased to 127 days on average.

Figure 2: Duration of Phase I reviews (days)

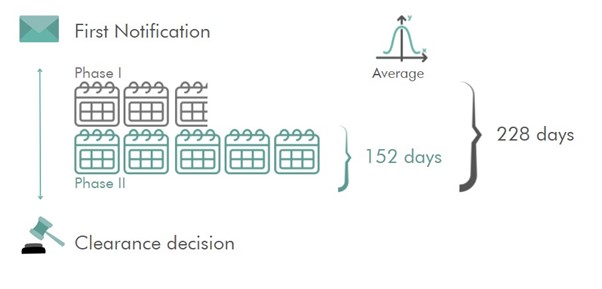

When a transaction is taken through to Phase II, a long waiting period begins for the merging parties. The average length of Phase II review in 25 years is 152 days. If we calculate from the date of the first notification, a transaction under Phase II review was concluded at the end of 228 days on average.

Figure 3: The average duration of Phase II reviews

Structural and Behavioural Remedies

For the TCA to clear the proposed merger, merging parties may make various commitments. The TCA has extensive guidelines on commitments that may be offered during merger proceedings. If the Board accepts these commitments, they are made binding for the parties, and the transaction is approved. These commitments can take the form of structural and behavioural remedies to address the competitive concerns raised by the TCA during the review procedure.

In principle, The TCA favours structural remedies over behavioural remedies. However, it was only sometimes feasible or even possible to offer structural remedies by the merging parties. Nevertheless, it may be meaningful to propose behavioural measures, especially if the parties can demonstrate the economic impact of the proposed action. [1]

We observe that a wide range of actions is accepted as behavioural remedies, such as the regular notification of commercial information to the TCA, guarantees to supply to former customers of the acquired company at competitive prices, guarantees to provide services to competitors in the downstream market, implementation of a competition compliance programme, no price increases above inflation rates, removal of non-competition and territorial exclusivity clauses from the distributors’ contracts, limitation of the exchange of customer information between companies at different levels, etc.

Figure 4: Phase II cases cleared with Structural remedies

| Industry | Transaction Parties | |

| FMCG | Gıdasa/ Marmara Gıda | 2008 |

| Printed media | Vatan Gazetesi/ Doğan Medya | 2008 |

| Cement | Lafarge/ OYAK Aslan Cement | 2009 |

| FMCG | Turyağ/ Besler Gıda-Ebubekir Çallı | 2010 |

| Alcoholic beverages | Mey İçki/ Diageo plc | 2011 |

| Movie theatres | AFM/Mars Sinema | 2011 |

| Baker’s yeast | Dosu Maya/ Lesaffre | 2014 |

| Supermarkets | Tesco/ Migros | 2017 |

| Agrochemicals | Monsanto/Bayer | 2018 |

| Lenses & glasses | Luxxotica/ Essilor | 2018 |

| Refrigeration compressors | Whirlpool kompresör/ Nidec Corp | 2019 |

Figure 5: Phase II cases cleared with Behavioural remedies

| Industry | Transaction Parties | |

| Steel tubes & pipes | Borusan/ Mannesman JV | 1998 |

| Printed media | Vatan Gazetesi/ Doğan Medya | 2008 |

| Ground services | THY/ Havaş TGS JV | 2009 |

| FMCG | Turyağ/ Besler Gıda | 2010 |

| Alcoholic beverages | Mey İçki/ Diageo plc | 2011 |

| Movie theatres | AFM/ Mars Sinema | 2011 |

| Baker’s yeast | Dosu Maya/ Lesaffre | 2014 |

| Steel cords for tire | Çelikord/ NV Bekaert SA | 2015 |

| Supermarkets | Migros/ Anadolu Endüstri H. | 2015 |

| Supermarkets | Tesco/ Migros | 2017 |

| Agrochemicals | Monsanto/ Bayer | 2018 |

| Port | Mardaş Port/ Arkas | 2018 |

| Lenses & glasses | Luxxotica/ Essilor | 2018 |

| Refrigeration compressors | Whirlpool compressor/ Nidec Corp | 2019 |

| Lenses & glasses | Grandvision/ EssilorLuxottica | 2021 |

Quantitative Economic Analysis in Merger Control

Quantitative analyses in merger filings first made it to the decisions in 2009 using the SSNIP test to determine the relevant geographic market (Lafarge Aslan Cement/OYAK). By 2011, merger simulations were used to estimate the possible prices of the market players after the transaction and the quantities they could sell at these prices (AFM/Mars). However, there were also cases where quantitative economic analyses by the TCA and the parties were not reflected in the decision (e.g., Dosu Maya/Lesaffre-2014).

Defining the markets is one of the critical challenges the merging parties face during the reviews. A broader definition of the market dilutes the market power of the merged identity and eases TCA’s competitive concerns. TCA conducted sophisticated geographic market delineations during its Phase II reviews using quantitative techniques in four cases. Interestingly, a quantitative study on the relevant product market analysis has yet to be conducted in a Phase II case.

Figure 6: Complex economic analysis in TCA’s Phase II cases.

Conclusion: Compulsory Additions to the Checklist of an M&A Attorney

Since Phase II reviews account for only 1% of the total notifications, the Turkish Competition Authority emphasises these reviews carefully. The outcome of the Phase II scrutiny can also be unexpected and sometimes unpleasant for the applicants. Out of a total of 53 transactions, 17 were accepted only with commitments and 5 were rejected, reducing the unconditional acceptance rate of a complex transaction to 58.5 per cent. Therefore, the M&A attorney should prepare diligently to overcome the complexities.

A Phase II review is also a long-lasting stressful process for the merging parties. There is always much pressure from shareholders, distributors, suppliers, and other stakeholders for a quick resolution. This pressure is projected on the lawyers responsible for the competition notification. However, the discussion between the competition authority and the merging parties is mostly reflected on economic grounds based on rigorous quantitative analysis. To shorten the review process, parties should make their commitment packages ready even before the notification of a complex transaction. Numerical demonstration of these commitments’ impact on competition in the market will increase their chances of acceptance.

TCA would most welcome structural commitments if they meet the general criteria, such as being based on economic foundations or protecting competition rather than competitors. Although behavioural commitments are subject to the same criteria, they come second due to the difficulty of monitoring them. It would also be beneficial to reply to the arguments of the Agency’s economists, which are often supported by numerical analyses, with the help of an economist.

_________

[1] Guidelines on Remedies That Are Acceptable by The Turkish Competition Authority in Merger/Acquisition Transactions, Turkish Competition Authority, paras 10, 19, 73.

* Any opinions or conclusions provided in this blog entry shall not be ascribed to ICR Economic Research or any clients of the firm involved in the reviewed cases.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.