On 13 October 2020, the European Commission (“EC”) adopted a fourth amendment to the Temporary Framework of 19 March 2020 (“Temporary Framework”). This amendment builds on the previous three amendments to the Temporary Framework of 3 April 2020 (see our blog post), 8 May 2020 (see our blog post) and 29 June 2020 (see our blog post).

The fourth amendment prolongs the availability of aid measures, allows for the Member States to grant aid in the form of a contribution to an undertaking’s fixed costs, and extends the temporary removal of all countries from the list of “marketable risk” countries under the Short-term export-credit insurance Communication (“STEC”).

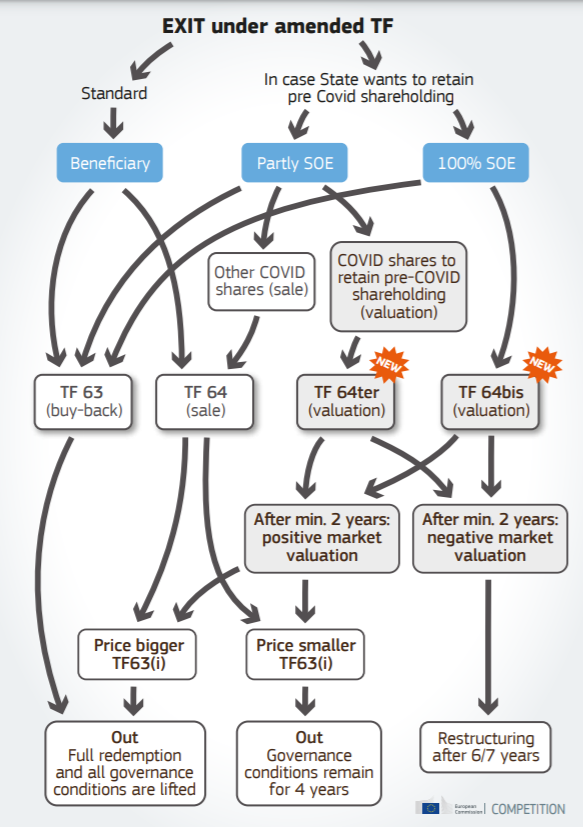

Further, the amendment offers some clarifications to the existing rules, in particular around State recapitalisation measures, introducing new mechanisms around a State’s exit from beneficiaries of COVID-19 recapitalisation.

Changes to the Temporary Framework

(1.1) Extension of the temporal scope of the Temporary Framework

The period of application of the measures set out in Temporary Framework has been extended from 31 December 2020 until 30 June 2021, except for recapitalisation measures, the limit for which has been extended from 30 June 2021 until 30 September 2021.

Prior to 30 June 2021, the Commission will review and examine the need to further the period of application or otherwise adapt the Temporary Framework.

(1.2) Member States may now cover part of companies’ fixed costs

The Commission has identified that many undertakings who face lower demand caused by the COVID-19 outbreak cannot cover all of their fixed costs. In order to give these undertakings a strong platform to recover when the expected return in demand occurs without enduring significant restructuring costs, Member States can now contribute to a part of the beneficiary’s fixed costs that are not covered by its revenues.

The aid must relate to uncovered fixed costs (i.e. not covered by profit contribution or other sources such as insurance or other temporary aid measures) incurred in the period between 1 March 2020 and 30 June 2021 or part thereof. To be eligible, the undertaking must have suffered a decline in turnover of at least 30% compared to the same relevant period in 2019.

This aid can be in the form of direct grants, guarantees and loans up to a maximum amount of EUR 3 million per undertaking.

(1.3) Extension of the temporary removal of all countries from the list of “marketable risk” countries under the STEC

The Commission undertook a public consultation to assess whether the current market situation would justify an extension to the removal of all countries from the list of “marketable risk” countries as set out in the STEC, beyond 31 December 2020. The responses received indicated that insufficient availability of private insurance capacity to cover exports to countries from the list of “marketable risk” countries can be expected to continue in 2021. In those circumstances, the Commission will consider all commercial and political risks associated with exports to the countries listed in the Annex to the STEC as temporarily non-marketable until 30 June 2021, in line with the extended duration of the Temporary Framework. The Commission will assess whether to prolong the temporary exemption before its expiration.

(1.4) Exit from State recapitalisation

The fourth amendment clarifies the means by which a Member State can exit from beneficiaries of COVID-19 recapitalisation. Before this amendment, the Temporary Framework envisaged two routes for the State to exit from undertakings:

- Under Point 63, the beneficiary can buy back the equity position of the State for the higher amount of: (i) the nominal investment by the State increased by a specified annual interest remuneration; or (ii) the market price at the moment of the buy-back.

- Under Point 64, the State may sell at any time its equity stake at market prices to purchasers other than the beneficiary. The sale should be an open and non-discriminatory consultation of potential purchasers or a sale on the stock exchange. The State may give existing shareholders, i.e. shareholders before the COVID-19 recapitalisation, priority rights to buy at the price resulting from the public consultation. If the State sells its equity stake at a price below the minimum price laid down in Point 63, the governance rules laid down in section 3.11.6 of the Temporary Framework shall continue to apply (see our previous blog post on these rules).

The amendment inserts two new possibilities relating to beneficiaries in which the State is an existing shareholder, i.e., before the COVID-19 recapitalisation. These can occur two years after the granting of the aid:

- Under new Point 64bis, if the State is the only pre-existing shareholder (i.e., the beneficiary is a 100% State-owned enterprise (“SOE”)), a sale is no longer required. In such circumstances, the State is deemed to have exited from the COVID-19 recapitalisation if an independent valuation establishes a positive market value. However, if the positive market value is less than the minimum price laid down in point 63, the governance rules laid down in section 3.11.6 shall continue to apply until four years after the grant of the measure.

- Under new Point 64ter, if the State is one of several pre-existing shareholders, separate mechanisms apply to aid replicating its pre-COVID recapitalisation equity positions and regarding any increased holding:[1]

- For the part of the COVID-19 equity that the State would need to retain in order to restore its shareholding to that before the COVID-19 recapitalisation, the possibility of Point 64bis applies – i.e. ‘exit’ based on an independent valuation. The amendment further notes that if the State sells a significant fraction of the shares of the beneficiary undertaking to private investors via a competitive process as referred to in Point 64, that process can be considered as the required independent valuation.

- For the remaining COVID-19 equity, a sale under Point 64 applies. The amendment further explicitly notes that the State does not have the priority rights mentioned in Point 64 in any such sale as it already exercised that right in restoring its pre-COVID-19 shareholding, as set out above.

The Commission has published the below flow chart showing the different options for State exit:

Additional Clarifications

The amendment also offers further clarification on the State’s exit under Point 64:

- Priority rights to existing shareholders under Point 64 should not cause the existing shareholders to exceed their stake in the equity of the beneficiary prior to the COVID-19 recapitalisation.

- The Commission also clarifies that the exit of the State from beneficiaries of COVID-19 recapitalisation through the mechanism of Point 64 requires a sale of the State’s equity stake at market prices to third-party purchasers.

Initial Observations

3.1 The continued need for aid

In the introduction to the fourth amendment, the Commission sets out need for the extension in the temporal application of the Temporary Framework. The Commission notes that according to its Summer 2020 Economic Forecast,[2] the EU economy is projected to contract by 8.3% in 2020, a deeper contraction than previously forecasted. Also due to the restrictions and the more permanent effects of the COVID-19 crisis, for example, increased unemployment and insolvencies, the Commission notes “there could be a slower, incomplete recovery.”

Given the current worsening of the crisis in Europe and with the spectre of further lockdowns across the continent, it seems clear that the expected recovery will still take some time. Against that background, it is sensible to allow the Member States to continue to have access to these set of tools to mitigate the economic impact. The scale of the take-up of the measures permissible under the Temporary Framework with every Member State having multiple schemes shows this has been a useful and valuable toolset.

3.2 Imbalance

The Commission notes that the use of the Temporary Framework has differed across the Member States and that this difference has “highlighted disparities in the Internal Market, mainly due to the differences in economic size and budgets of Member States.”

The Commission uses this as a justification for the prolongation of the Temporary Framework; however, a mere extension will unlikely solve this imbalance in the absence of wider measures such as the EU Recovery Fund to allow smaller Member States access funds. It will need to be seen how this extension will interplay with measures adopted under the EU Recovery Fund, with the Member States already taking different approaches under their national recovery plans.[3] It is clear that in the absence of aid granted directly by the Commission, it can only do so much to ensure a level playing field.

3.3 No extension of the scope

In our most recent blog post, it was mentioned that there have been calls to increase the scope of companies allowed to access the measures allowed under the Temporary Framework, especially in relation to highly leveraged companies. Since then, national governments have themselves started to address this, for example, the UK is permitting more flexibility about whether a business is deemed an “undertaking in difficulty” to allow private equity-backed groups access to aid.[4]

Despite canvassing the Member States on the impact and the effectiveness of the Temporary Framework, the Commission has not seen a need to extend the application of the Temporary Framework to larger companies than the micro and small enterprises allowed for under the third amendment. However, given the ongoing development of the COVID-19 outbreak, the response to it and the likely prolonged economic impact, further extensions or amendments cannot be ruled out.

The views expressed by the author in this blog post are entirely personal and cannot be attributed to Kirkland & Ellis.

[1] The Commission includes an example in the Temporary Framework “[p]re-recapitalisation, the State owns 50% of the beneficiary undertaking. Following the COVID-19 recapitalisation, the State owns 90% of the undertaking (10% shareholding concerns pre-COVID-19 State-owned shares and 80% shareholding concerns COVID-19 shares). Two years after the COVID-19 recapitalisation, the State sells 40% of the undertaking (corresponding to 50% of the COVID-19 shares) via a competitive process to private investors (for positive market value), in application of point 64ter, letter (b). The State retains the remaining part in application of point 64ter, letter (a). The sale is akin to an independent valuation of the company. The State is deemed to have redeemed the COVID-19 recapitalisation since the part of COVID-19 shares it retains restores its shareholding to pre-COVID-19 levels, i.e., 50%, and is equivalent to the State exercising its priority right under point 64. If the market price of the COVID-19 equity is less than the minimum price laid down in point 63, the governance rules laid down in section 3.11.6 continue to apply for two more years.’”

[2] European Commission, Economic and Financial Affairs: Summer Forecast 2020 (Interim) (July 2020)

[3] https://www.euractiv.com/section/politics/news/eu-countries-warm-up-recovery-fund-engine/

[4] https://www.ft.com/content/91057524-d8c3-4912-b5df-572f46d7f050

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.