Common ownership currently is one of the focus topics in the antitrust community. Einer Elhauge, a Harvard Law professor, has called it the “greatest anticompetitive threat of our times”. Others believe that there is no issue at all. The below gives an overview on the status of the debate and analyses the recent EU Commission (EC) decisions dealing with common ownership more closely.

Overview

Common ownership is the simultaneous ownership of shares in competing firms by institutional investors below the level of control. These institutional investors (banks, pension funds, insurance companies or mutual investment funds) normally have small minority shareholdings of 5% or much less and typically no board representation, i.e. their investment is purely passive.

Traditionally common ownership has not been seen as an antitrust issue. This view has however been called into question as:

- Multiple institutional investors can combined hold a large percentage of shares in companies;

- The claim by some is that institutional investors actively engage with firm management; and

- Common ownership has become a lot more common. For instance, 60% of US public firms in 2014 had shareholders that also held at least 5% in a competing firm, up from 10% in 1980[1]He / Huang, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2380426

Certain recent theoretical and empirical studies (in particular the Azar / Schmalz / Tecu airlines paper[2]Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2427345) have concluded that common ownership may have a detrimental effect on market competition in certain concentrated sectors, particularly in airlines, retail banking and pharma. These studies find that in oligopolistic markets where competitors have shareholders in common (1) prices may be higher, (2) collusion may be more likely and (3) management incentives may be oriented towards industry performance and not firm performance.

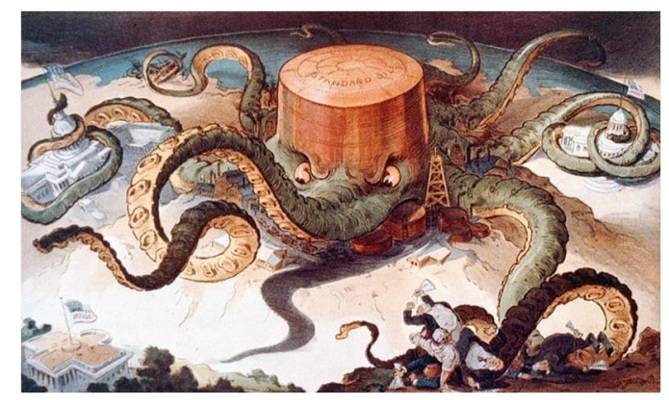

These concerns have led to far-reaching proposals about using either current or new antitrust laws to control or limit common ownership and some voices are calling for action to “dismember the octopus“. For instance, Posner / Morton / Weyl [3]https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2872754 propose that investors in firms in well-defined oligopolistic industries would be limited to a holding of a small stake (no more than 1% of the total size of the industry) or holding shares of only a single firm per industry. Others have suggested to establish broader safe harbors for common ownership (e.g. a 15% threshold (Rock / Rubenfeld)[4]See https://one.oecd.org/document/DAF/COMP(2017)10/en/pdf. However, these papers have been strongly disputed by investors such as BlackRock[5]E.g. https://www.blackrock.com/corporate/literature/publication/ftc-hearing-8-competition-consumer-protection-21st-century-011419.pdf and a number of academics[6]E.g. Dennis / Gerardi / Schenone, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3063465 as to their theoretical as well as empirical foundations.

Common ownership started as an academic debate but has now caught the attention from competition authorities, the media and other stakeholders:

- The EC took common ownership into account in two recent high-profile merger cases, namely Dow / DuPont (2017) and Bayer / Monsanto (2018);

- In December 2018, the US Federal Trade Commission held a hearing on common ownership which led to strong (negative) reactions from investors and index providers[7]FTC Hearing #8: Competition and Consumer Protection in the 21st Century, 6 December 2018;

- Common ownership and its impact on competition was also a topic at the OECD roundtable discussion at the end of 2017;

- The German Monopolies Commission has repeatedly recommended that indirect minority shareholdings by institutional investors receives more attention at EU level and that due to its omnipresence is of greater competition policy relevance than expanding the EU Merger Regulation to include non-controlling minority shareholdings[8]XXII. Biennial Report of the Monopolies Commission (Chapter II) and XXI. Biennial Report of the Monopolies Commission (Chapter III).

Key points from the relevant EC decisions

In the Dow / DuPont[9]http://ec.europa.eu/competition/mergers/cases/decisions/m7932_13668_3.pdf in particular Annex 5 and Bayer / Monsanto[10]http://ec.europa.eu/competition/mergers/cases/decisions/m8084_13335_3.pdf, see in particular paras 208-229 agrichemical merger cases the EC concluded the following:

Significant common ownership exists in the agrochemical industry, e.g. in Dow / DuPont: 17 shareholders collectively owned ca. 21% in BASF, Bayer and Syngenta and 29-36% of Dow, DuPont and Monsanto.

As a result of significant common ownership, market shares and concentration measures (such as HHIs) underestimate the concentration of the market structure and market power of the parties as they are based on the assumption that the firms are fully independent from each other (paras 61 et seq. of Annex 5 of the Dow/DuPont decision).

Common shareholding has to be taken into account as an “element of context” when assessing whether the transaction raises competition concerns (paras 4, 81 of Annex 5 of Dow / DuPont). The EC does however not formulate a stand-alone unilateral or coordinated effects theory of harm with regard to common ownership (and it would, given the state of the debate, be unclear what that theory of harm would exactly be).

In its decisions, the EC comes to a number of rather one-sided and categorical conclusions:

- According to the EC, based on economic literature, the theory of harm for “cross-shareholdings” applies also to common shareholdings (para 45 of Annex 5 of the Dow / DuPont decision). Cross ownership relates to a direct ownership of stock in a competitor by another competitor and there is established enforcement practice that significant cross ownership can potentially have anti-competitive effects (see e.g. the EC’s decision in JNJ/Actelion[11]http://ec.europa.eu/competition/mergers/cases/decisions/m8401_740_3.pdf). However, holding significant shares in a competitor and indirect passive minority shareholdings of institutional investors is not the same thing, in particular as incentives of common ownership shareholders may be very different from that of a single competitor and driven by a number of considerations (driven by their cross-industry investments).

- The EC also relies on public statements made by large investment funds to support the claim that passive investors exercise influence over their portfolio companies, e.g. a statement from Vanguard’s chairman and chief executive: “in the past some have mistakenly assumed that our predominantly passive management style suggests a passive attitude with respect to corporate governance. Nothing could be further from the truth.”[12]Dow/DuPont (para 23), Bayer / Monsanto (para 215) It would indeed be helpful to understand some of these statements better, but they seem by themselves not a sufficient reason to factor common ownership into the assessment given that they are anecdotal and not case-specific. It appears that the EC did not find any “hard evidence” (in particular no internal documents) that would have suggested any such influencing actually took place. It is not that the EC did not look at any documents. In both cases the number of documents requested by the EC were record-breaking (according to the EC’s press release it reviewed 2.7 million documents in Bayer / Monsanto[13]http://europa.eu/rapid/press-release_IP-18-2282_en.htm). In the absence of any concrete documentary evidence, the EC was therefore not able to conclude that large shareholders influenced company management in these cases. All the EC mentions in Dow / DuPont is that: “large shareholders have a privileged access to companies’ management and can therefore share their views and have the opportunity to shape the companies management’s incentives accordingly.” (para 21 of Annex 5).

- The EC strongly relies on economic literature (the Schmalz airline paper etc.) who find that common shareholders have a negative impact on price competition (paras 52 et seq. of Dow/DuPont). These are however one-sided references to certain academics opinions and other economic literature is not taken into account (in fairness this is an evolving debate and more academic papers are available now than at the time of Dow / DuPont).

- According to the EC, large “passive” common shareholders have different incentives than non-common shareholders (para 46 et seq. of Dow/DuPont). Essentially, the underlying theory claims that when an investor owns equity in multiple competing companies within an industry, the companies’ management may have the incentive to maximize the investor’s total equity portfolio profits resulting in reduced competition between competitors. So common ownership investors have different incentives from single firm shareholders who want to maximize profits of the individual firm. However, as stated in the OECD 2017 paper, the investor may have diversified holdings across industries which may counteract any such allegedly anticompetitive incentives[14]https://one.oecd.org/document/DAF/COMP(2017)10/en/pdf (with reference to Rock / Rubenfeld (2017), Antitrust for Institutional Investors, New York University School of Law, Law & Economics … Continue reading. By way of example, assuming that common ownership drives up airline ticket prices, companies in which the investor has minority shareholdings may have to foot the bill and will therefore be less profitable. Price increases in the industry may also have an impact for suppliers (e.g. fuel providers, airplane builders) in which the investor may hold stock as well, e.g. if people were to fly less as a result of price increases.

- The EC also finds that the theory that common ownership leads to less price competition can be applied to innovation competition. The theory is that by increasing R&D efforts a firm foregoes current profits. Future benefits for the firm increasing R&D efforts will materialize through price competition (at least in the agrochemical industry). According to the EC, this means there will be downward impact on current benefits of the firm and future benefits of competitors. This negatively affects the portfolio of shareholders that hold positions in the firm and competitors and makes competition innovation less attractive for common shareholders. So goes the theory. The EC however comes to this conclusion in only one paragraph (para 59 of Annex 5) without relying on any third party economic evidence. One could, for instance, argue that the presence of a long-term passive index investor may have a positive impact on innovation within a company.

- Common ownership benefits, e.g. for individual stockowners who are not able to diversify their portfolio to the extent institutional investors can, are not considered in the EU common ownership decisions.

- Both common ownership cases required divestments in order to be cleared by the EC. Divestment purchasers were major industry players in common ownership with rivals: FMC (in Dow/DuPont) and BASF (in Bayer/Monsanto). In Bayer/Monsanto, the EC found that common ownership should not disqualify BASF prima facie as a suitable purchaser with regard to its independence. The EC argues that “the debate regarding common shareholdings is relatively recent and not yet entirely settled” which does not seem consistent with the conclusion it reaches in the same the decision which is that common ownership has to be taken into account for assessing effects of the main transaction (see paras 3302 et seq. of the Bayer / Monsanto decision).

What to expect going forward

Competition Commissioner Vestager said in early 2018 that the EC will investigate (1) how common common ownership is in Europe and (2) what its effects are. In Bayer / Monsanto, the EC recognizes that the debate regarding the effects of common ownership is “on-going” and “not yet settled” (paras 228, 3302). Nevertheless, the EC took common ownership into account in its competitive assessment. The EU Parliament has recently called on the EC “to take all necessary measures to deal with the possible anti-competitive effects of common ownership” and “to investigate common ownership and draw up a report (…) particularly on prices and innovation”[15]http://www.europarl.europa.eu/doceo/document/A-8-2018-0049_EN.html?redirect. This EC report is still to be published.

Given that there now is common ownership precedent, parties have to expect increased scrutiny of mergers of competing portfolio companies in industries where common ownership exists. The EC will likely take the view that market shares underestimate concentration in the industry and that competitors will not compete fiercly with the merging parties as result of common ownership. The common ownership “element of context” will make it harder to persuade the EC that the merger does not raise competition concerns.

Any change to the EU merger rules that would allow for scrutiny of minority acquisitions by institutional investors in competing firms seems however highly unlikely in the current political climate in the aftermath of the Siemens / Alstom merger prohibition and given that Commissioner Vestager decided not to pursue the introduction of a review system for non-controlling minority shareholdings acquisitions a few years ago.

Useful links

https://one.oecd.org/document/DAF/COMP(2017)10/en/pdf

https://www.monopolkommission.de/images/HG22/Main_Report_XXII_Common_Ownership.pdf

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.

References