1. More Deals Receive More Scrutiny

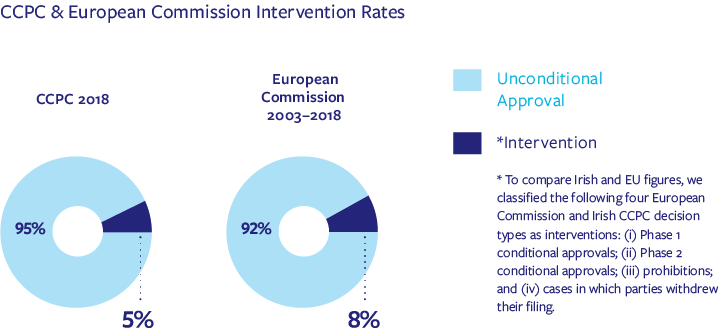

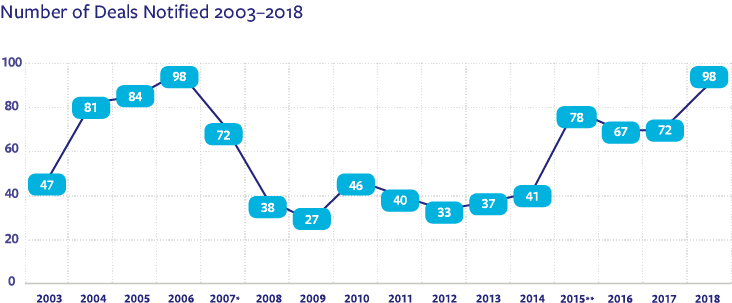

Of 98 deals notified, 11 received extended CCPC review (including 4 Phase 2 reviews) – the most extended reviews ever conducted by the CCPC in a single year. While no deal was blocked outright, 5 were cleared conditional on CCPC-approved remedies, including, in one case, a business divestment remedy. The CCPC also used mandatory powers to compel information disclosure more often and, in another first, is pursuing a criminal prosecution in a gun-jumping case. Overall CCPC intervention rates are lower than EU levels.

2. Complex Deal Reviews Get Longer

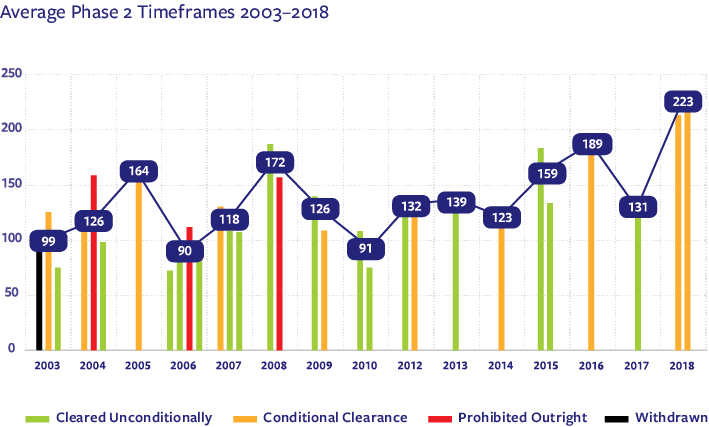

No-issue deals typically took 5 weeks to clear, in line with past CCPC practice. But CCPC review of complex deals took significantly longer in 2018. Two Phase 2 reviews were completed in 2018 (two others are on-going). Each took well over 200 days, compared to a previous record from 2016 of 189 days. In one case, the CCPC used new powers to stop-the-clock at Phase 2, introduced in 2014, for the first time. More demanding market surveys may also account for delays.

3. Difficult Deals Still Get Through

The CCPC hasn’t blocked a deal outright in over a decade. But the CCPC has imposed both structural and behavioural fixes, most notably ring-fencing and firewall style commitments. This trend continued in 2018. Of 5 conditional clearances, 4 involved ring-fencing to prevent exchange of competitively sensitive information in acquisitions of minority stakes in rivals and, in one case, to address “anti-competitive vertical information sharing.” In a first since 2016, the CCPC also required divestment of an overlap business, along with access commitments to waste processing facilities. This is the sixth time in 16 years of merger control that the CCPC conditioned deal approval on a divestment remedy.

4. Fewer, Simpler Filings?

New filing thresholds effective from 1 January 2019 will decrease the number of filings by 40%, by CCPC estimates. From 1 January 2019, deals are caught only if both target and buyer each had over €10 million Irish revenues (up from €3 million) in the last financial year and combined both parties’ Irish revenues were over €60 million (up from €50 million). These new thresholds will mean fewer filings of acquisitions of small Irish businesses, but may not materially reduce filings of international deals with an Irish element. The CCPC also announced plans for a simplified merger review process for deals with no or minimum overlap, although when these plans will be implemented is not yet clear.

5. What about Brexit?

The CCPC says it is planning for an increase in the number of complex mergers notified in Ireland following Brexit. New 2019 merger notification thresholds, designed to exclude smaller Irish deals and thereby free up CCPC resources, are doubtless part of this planning, as are CCPC proposals for a simplified notification procedure. Not yet clear, however, is whether resources in the Mergers Division will increase.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.