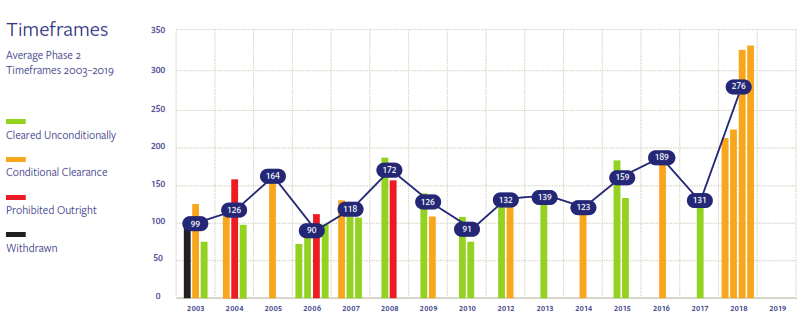

- P2s Get Longer, But P1s Don’t!

Two 2018 P2s, cleared in 2019, took over 320 days. One of the two decisions is published and runs to 240 pages. In 2003, Year 1 of modern Irish merger control, a P2 averaged 100 days and a typical P2 decision was 20 pages. But delays to “no-issue” deals haven’t materially increased: P1 clearance averaged 5 weeks in 2019.

- Intervention Rates Climb

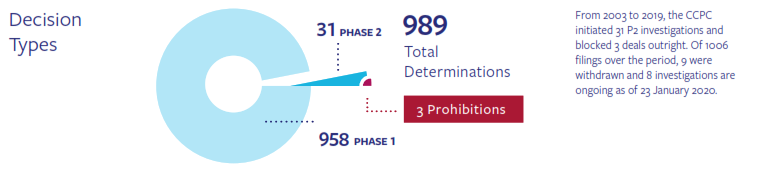

The CCPC intervened in 9% of 2019 cases (with 8 ongoing as of today), up from an average annual rate of 5%. No deal was blocked outright. But behavioural commitments, a major instrument of CCPC merger policy, are increasingly common. In one case, full separation of a buyer’s business was required even though overlaps largely pre-existed the merger. In another, novel access rights at set prices were imposed.

- Company Statements in Sharp Focus

A single pre-deal statement by a target, contested as unreliable “loose talk” by the merging parties, was for the CCPC highly probative evidence of likely adverse effects. Prejudicial buyer statements in one internal email and a single slide presentation were also relied on by the CCPC as high-value evidence. But the CCPC has yet to make mass document or email disclosures demands a routine part of complex merger review.

- Due Process Issues Cause Friction

Evidence redactions, file access and use of confidentiality rings were hotly contested in a first P2 in 10 years to involve oral pleadings. The CCPC refused outright merging party requests to provide certain evidence, providing instead non-confidential summaries. The CCPC is now reviewing its file access rules.

- A Pre-Notification Requirement for Straightforward Cases Only?

Could EU/UK-style pre-filing delays arrive by stealth? In 2019, the CCPC declared 3 filings invalid for failure to include requisite information – a first in 17 years. A Simplified Notification Procedure for non-controversial deals with no or limited horizontal (15%) or vertical (25%) overlap is to start this year. The CCPC hasn’t yet said how quickly simplified deals will be cleared, but has said “pre-notification discussion could be particularly beneficial.”

- Gun-jumping: A Zero Tolerance Policy?

Before 2019, the CCPC never sought to penalise gun jumping (i.e., taking control prior to clearance). At worst, offenders were named and shamed in CCPC press statements. 2019 saw a first prosecution: following an 18 month investigation, the perpetrator was ordered to make a small charitable donation of €2,000.

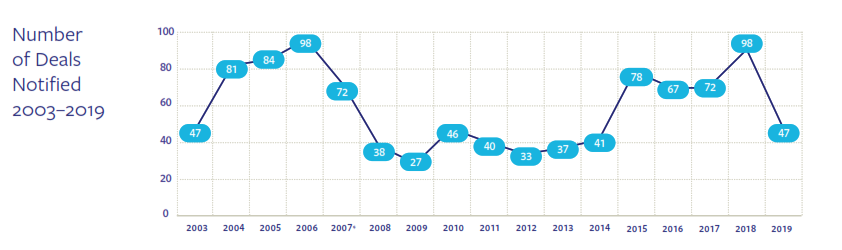

- New 2019 Thresholds Reduce Filings

Revised thresholds introduced on 1 January 2019 successfully achieved a CCPC policy goal to reduce merger notifications by 50%: filings dropped from 98 in 2018 to 47 in 2019. Requirement in particular that both parties to a deal have Irish revenues of at least €10 million (previously €3 million) excludes many smaller Irish deals.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.