As we approach the second anniversary of the EU Foreign Subsidies Regulation (FSR), we take stock of the latest statistics and offer practical insights for private equity (PE) sponsors. Drawing on our extensive experience advising funds, we set out the key takeaways for PE investors navigating the FSR notification process.

PE sponsors are the most frequent notifying parties under the FSR

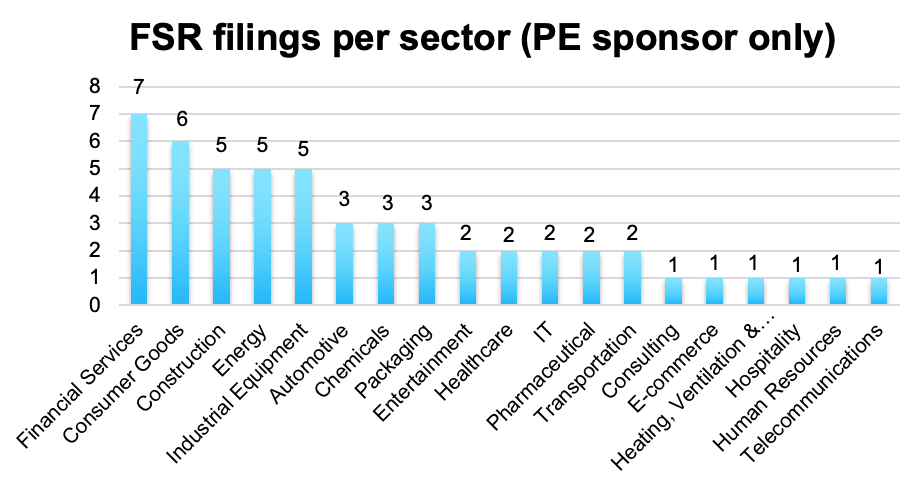

According to the European Commission’s (EC) FSR registry, there have been 179 FSR filings to date, with the EC currently receiving an average of seven filings per month. Roughly a third of all notifications have been submitted by PE sponsors, making them the single largest category of notifying parties under the FSR regime. FSR filings from PE sponsors span a broad range of sectors, with the most active areas being financial services, consumer goods, construction, energy and industrial equipment.

While the FSR regime only applies to large M&A transactions with a strong EU nexus, PE sponsors often trigger the regime due to the group-wide nature of the financial contribution threshold. Specifically, an FSR filing is required if:

- The target generated at least €500 million EU turnover in the financial year prior to the transaction; and

- The acquirer and the target combined received more than €50 million in foreign financial contributions (FFCs) from non-EU countries over the three years prior to signing the agreement (of acquiring control).

For PE sponsors, this €50 million FFC threshold is frequently met because:

- The test applies at the global group level, including all funds managed by the same GP, and all of the funds’ controlled portfolio companies and JVs;

- Capital raised from Limited Partners (LPs) with non-EU sovereign links may qualify as FFCs, even if they are only passive investors.

The EC is increasingly attuned to the nature of PE structures, particularly around how capital is raised, how funds are managed, and how foreign-state involvement manifests. As a result, the review process is gradually becoming more consistent and predictable — particularly in areas like the assessment of fund-by-fund exemptions and LP disclosures.

The fund-by-fund exemption

One of the most impactful FSR simplifications for PE sponsors is the “fund-by-fund” exemption. It allows them to limit the scope of their FSR disclosure to only the fund(s) acquiring the target (the “Acquiring Fund(s)”), excluding other funds under common management by the same GP, if:

- There is a sufficiently distinct LP base (typically, if 50% or more of the capital / profit interests are held by different investors); and

- There are limited or no commercial transactions between the acquiring and non-acquiring funds or their portfolio companies.

To benefit from the exemption, the EC typically expects:

- An anonymised breakdown of LP commitments (and profit entitlements, where applicable) across the fund structure;

- Confirmation of limited cross-fund dealings, with any inter-fund transactions disclosed and confirmed to be on arm’s-length terms;

- The GP or fund manager is subject to the EU AIFMD (EU Directive 2011/61/EU) or a comparable third-country regime (e.g. in the UK or U.S.).

This exemption is a critical tool to reduce the complexity, information gathering burden and cost of FSR filings. That said, funds should ensure internal compliance tracking to evidence fund separateness and maintain documentation of arm’s-length inter-fund arrangements.

Scope of disclosure for the acquiring fund(s)

The EC takes a close interest in the deal financing and the composition of the LP base. For the Acquiring Fund(s), this includes:

- Anonymised LP list detailing commitments and corresponding capital shares: While identities of non-EU State-linked LPs (e.g. sovereign wealth funds or SOEs) do not need to be disclosed, the presence of such investors must be mentioned, as their contributions may qualify as FFCs.

- Investment terms: The EC assesses whether LPs invest on pari passu terms. Preferential rights (e.g. elevated profit shares or special governance rights) for non-EU State-linked LPs may trigger further scrutiny.

- Governance rights: The EC distinguishes between passive LPs (typical in most PE structures), investors who have meaningful governance rights, such as veto rights, or other powers allowing them to influence investment decisions, and co-investors who invest directly in the target. Co-investors are generally subject to greater interest of the EC, especially if their contributions are earmarked for the deal or where they hold different governance or economic rights to the other investors.

- FFC disclosure: For the Acquiring Fund(s), this includes FFCs only received directly or by controlled portfolio companies or JVs.[1] The breadth of this disclosure obligation will depend on the fund’s maturity and the geographic scope of its portfolio. Where more than one fund is involved, more information will need to be disclosed. Older funds with a larger number of diverse portfolio companies will typically have more FFCs to disclose, while more recently formed funds with fewer portfolio companies will face a lighter disclosure burden. Gathering this information could take time (particularly for PE funds with significant operations outside the EU), but experienced FSR counsel can help navigate this process efficiently.

Waivers

Given the complexity of PE structures, waiver requests are common and PE sponsors account for the majority of them. The EC may grant waivers where:

- The requested information is not reasonably available, e.g. for portfolio companies sold more than three years ago; or

- Certain FFC disclosures are not relevant to the competitive assessment, especially where there are no overlaps in the deal.

In our experience, the EC is pragmatic in handling waiver requests, particularly when parties engage early, and the waiver rationale is clearly explained.

Push for simplification

In the typical LP funding structure, all investors are generally passive and invest on pari passu terms, which makes the FSR filings of the PE funds largely unproblematic. As the EC has become more familiar with PE structures and investment dynamics, it is asking fewer questions than it did at the start of the regime. Pre-notification can also move quickly (as short as one month) where parties front-load the process and come prepared.

In light of the above, the EC has publicly discussed the idea of introducing a simplified FSR filing process for PE funds— whether through a streamlined filing process or an ad hoc simplified procedure for PE deals (given the number of transactions caught, the reporting burden, and the fact that most FFCs relate to passive LP investments and rarely raise substantive concerns). That said, any meaningful changes will likely depend on the EC’s formal review of the FSR, expected to begin in June 2026, which will include a report on enforcement and any proposed changes to revise the FSR thresholds.

While the FSR has introduced new complexity for large-cap PE transactions in Europe, the regime is stabilising. The EC has shown flexibility and a willingness to adapt to market realities — especially for PE funds, which are among the most active dealmakers and most impacted by the regime’s mechanics.

****

Anastasios Tsochatzidis (White & Case, Trainee, Brussels) contributed to the development of this post.

[1] The concept of “control” under the FSR is the same as under the EU Merger Regulation. Pursuant to Article 3(2) of the EU Merger Regulation (replicated in Article 20 of the FSR), “Control shall be constituted by rights, contracts or any other means which, either separately or in combination and having regard to the considerations of fact or law involved, confer the possibility of exercising decisive influence on an undertaking, in particular by: (a) ownership or the right to use all or part of the assets of an undertaking; (b) rights or contracts which confer decisive influence on the composition, voting or decisions of the organs of an undertaking”.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.