2024 marked the third year in which the Antimonopoly Committee of Ukraine (AMCU) exercised its statutory powers amid the challenges of the full-scale war. Yet, as of 2025, the regulator has demonstrated remarkable agility, remaining fully operational – reviewing merger control notifications, commencing investigations, issuing decisions, as well as dedicating significant efforts to aligning Ukrainian competition law with that of the European Union (EU).

In this blog post, we provide a summary of the year’s key developments. We begin with fine statistics and enforcement trends, highlight priority sectors targeted by the regulator, and review merger control activity. We then examine enforcement in areas such as bid rigging, unfair competition, and informational violations; spotlight the first-ever application of the leniency procedure; and summarize the AMCU’s efforts in state aid control and competition law reform. Finally, we outline the AMCU’s enforcement priorities and provide an outlook for 2025.

Fine Statistics

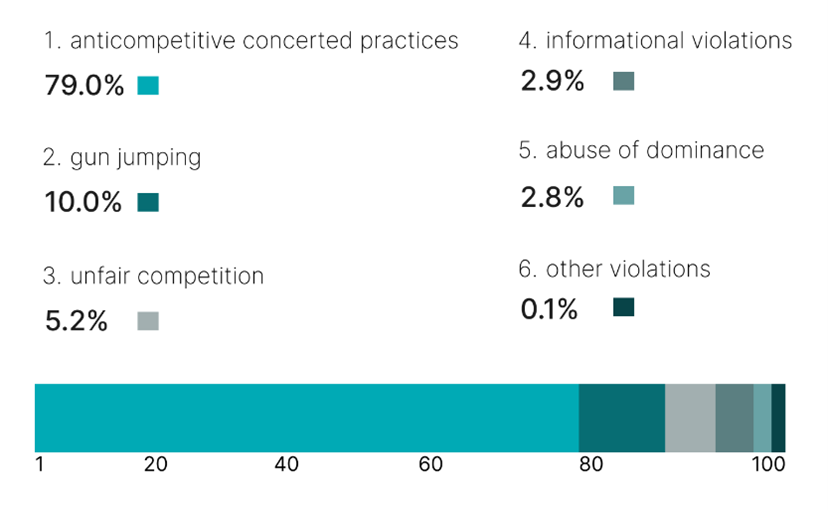

Throughout 2024, the regulator issued 1,146 decisions on violations of Ukrainian competition law, imposing fines totaling just over UAH 1 bln. (approx. EUR 23 mln.). Of the UAH 1 billion in fines imposed by the regulator in 2024, nearly 90% stemmed from two types of violations: anticompetitive concerted practices and gun jumping. Notably, bid rigging accounted for 100% of the total fines imposed for anticompetitive concerted practices. The AMCU also investigated 47 gun-jumping cases, representing 10% of the total fines imposed. Violations related to unfair competition, informational violations, and abuse of dominance accounted for 5.2%, 2.9%, and 2.8% of the total fines, respectively.

Figure 1. Breakdown of the AMCU fines by Type of Violation

Sectors Targeted by the AMCU

Throughout 2024, the regulator enforced Ukrainian competition law across a broad range of industries, namely:

Figure 2. Sectors at the AMCU’s Spotlight in 2024

Merger Control

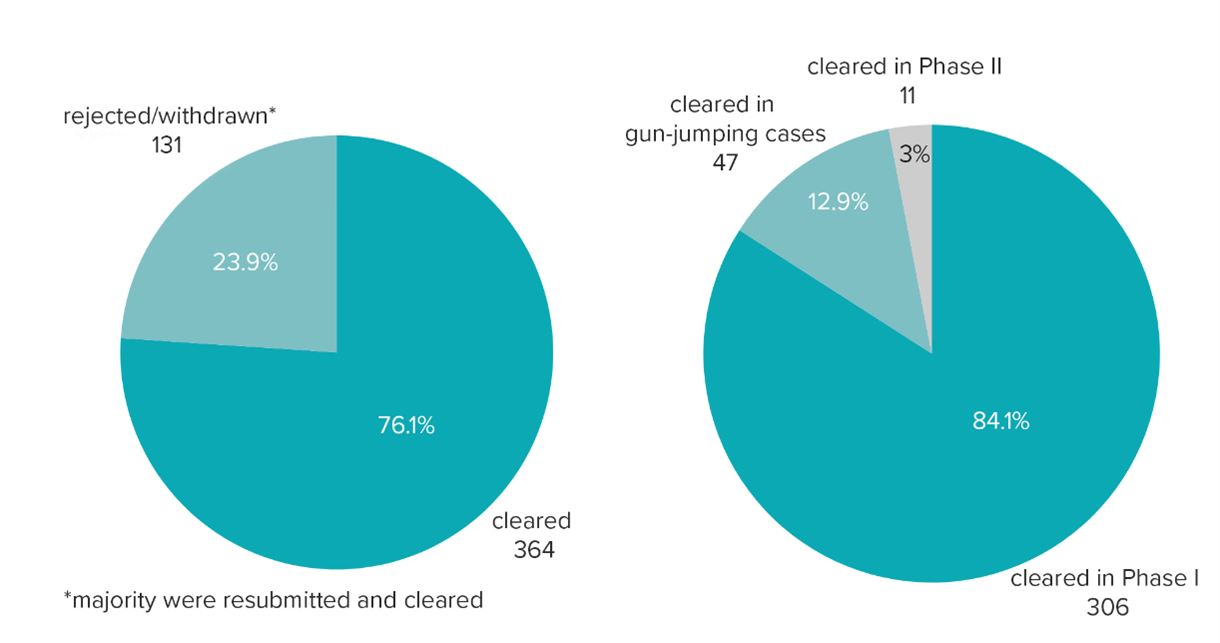

The AMCU was busy with merger control reviews in 2024, having reviewed 496 notifications, of which:

- 364 were processed and resulted in merger clearances;

- 131 were either rejected due to non-compliance with formal requirements or withdrawn by the parties on their own initiative. It is worth noting, however, that most of the rejected notifications were subsequently rectified and resubmitted by the parties, ultimately receiving merger clearance and contributing to the total of 364 approved mergers [1];

- 1 case was closed without a decision on the merits.

The majority of clearances (306 out of 364) were granted in Phase I as the respective mergers posed no threat to domestic competition. Competition concerns, however, were identified in 11 cases, which were ultimately cleared in Phase II following an in-depth review by the AMCU – 4 of these were subject to remedies. The remaining 47 clearances were issued in gun-jumping cases, where transactions were completed without prior AMCU’s clearance, but the parties voluntarily submitted their filings to the regulator post-closing.

Also, in 2024, the AMCU issued 51 preliminary conclusions on mergers. These are issued in response to specific notifications and reflect the AMCU’s initial assessment of whether a transaction requires merger clearance and whether such clearance is likely to be granted.

Figure 3. 2024 Merger Control Statistics

Notable Mergers

The largest transactions by value cleared in Phase I by the AMCU in 2024 included:

- $8.5 billion merger of Reliance Industries’ and Walt Disney’s Indian media assets;

- $4 billion acquisition of Broadcom’s End-User Computing Division by KKR;

- $3.6 billion merger of Berry Global’s Health, Hygiene and Specialties Global Nonwovens and Films business with Glatfelter.

Out of deals having appreciable nexus in Ukraine, the following are worth mentioning:

- Merger of Bunge and Viterra. The AMCU’s assessment focused on two markets: agricultural products and the transshipment of vegetable oil at the Mykolaiv port. Regarding the first market, the AMCU concluded that the parties’ combined market shares were moderate and the market itself was highly competitive. As for the second market, the regulator noted that the importance of the Mykolaiv port had declined following the beginning of the full-scale war in Ukraine in February 2022. This led to a shift in demand to other ports, along with a decrease in the volumes of oil production and transshipment. The AMCU concluded that the transaction would not result in monopolization or a restriction of domestic competition and, therefore, granted the clearance.

- Acquisition by MSC of Hamburger Hafen und Logistik AG and the Port of Hamburg.

The AMCU concluded that the transaction could adversely affect competition in the container terminal of the Odesa seaport. To mitigate this risk, the regulator cleared the transaction subject to certain behavioral remedies imposed on the buyer, in particular, an obligation not to unjustifiably restrict third-party access to container terminal services and terminal’s infrastructure. Access must be granted on fair market terms and with at least 30% of the terminal’s annual available design capacity allocated accordingly. - Acquisition by CRH of Dyckerhoff Cement Ukraine. The parties were close competitors with high market shares in the Ukrainian market for gray Portland cement. To prevent the monopolization of the market, the transaction was cleared subject to certain structural remedies, including:

(1) the divestiture of 25-28% of shares in Dyckerhoff Cement Ukraine (Dyckerhoff), along with certain veto rights, to an independent third party; (2) the appointment of only independent executives at Dyckerhoff; (3) the prohibition to unjustifiably refuse to supply cement to third parties, as well as the obligation to maintain existing production capacities; (4) the application of market-based pricing and fair contract terms to all cement buyers; (5) the prohibition to unjustifiably restrict third-party access to the cement market; and (6) the prohibition on clinker exports that would prevent fulfillment of third-party cement orders.

Gun Jumping

Local Transactions

In 2024, the AMCU imposed fines totaling UAH 101.5 mln. (approx. EUR 2.3 mln.) for gun-jumping violations. More than a half of that amount was imposed in the following local transactions:

- UAH 37.3 mln. (approx. EUR 0.84 mln.) fine for the acquisition of control by PJSC “Kyiv Cardboard and Paper Mill” over LLC “Autospetstrans-Kyiv Cardboard and Paper Mill,” which took place back in 2017;

- UAH 21.3 mln. (approx. EUR 0.48 mln.) fine for the acquisition by LLC “Pulp Mill Print” of certain assets and entity of Blitz-Inform group, which took place back in 2019.

The regulator identified that the buyers in these transactions (PJSC “Kyiv Cardboard and Paper Mill” and LLC “Pulp Mill Print”) belong to the same corporate group. Repeated violations by entities within the same group may be considered an aggravating factor by the regulator and could contribute to the imposition of higher fines.

Foreign-To-Foreign Transactions

Additionally, in 2024, the AMCU imposed fines for closing foreign-to-foreign transactions without the regulator’s clearance:

- UAH 4.5 mln. ( EUR 0.11 mln.) fine for the creation of a joint venture between Electricite de France, Nebras Power, Sojitz Corporation and Kyuden International Corporation;

- UAH 2.5 mln. ( EUR 0.06 mln.) fine for the acquisition by Sika of control over MBCC;

- UAH 0.47 mln. ( EUR 0.01 mln.) fine for the acquisition by YILFERT Holding of control over Rosier SA; and

- UAH 0.05 mln. ( EUR 0.001 mln.) fine for the acquisition by Cheplapharm of control over certain pharmaceutical assets. [2]

Bid Rigging

In 2024, the AMCU continued its traditional focus on identifying bid-rigging violations – i.e., the distortion of results of bids, auctions, tenders, and public procurements – which constitute one of the types of anticompetitive concerted actions under Ukrainian competition law. Last year, the regulator issued 2,012 decisions related to anticompetitive concerted actions, 100% of which being bid-rigging violations. The highest fine imposed for bid rigging during the year totaled UAH 106 mln. (approx. EUR 2.4 mln.).

It is worth mentioning that the AMCU has developed strong expertise in tackling this type of violation. In Ukraine, bid rigging is considered a per se violation, and thus the regulator is not required to prove a negative effect on domestic competition. Furthermore, fines for bid rigging may reach up to 10% of the annual turnover per violation; however, the most adverse consequence is not the fine, but rather the prohibition from participating in public procurements for the next three years.

Unfair Competition

In 2024, the AMCU identified 58 violations of the Law of Ukraine “On Protection Against Unfair Competition” (Unfair Competition Law), with total fines amounting to UAH 53.3 mln. (approx. EUR 1.2 mln.). The highest fine imposed by the AMCU for unfair competition last year was UAH 17.7 mln. (approx. EUR 0.4 mln). Traditionally, the most frequent violation of the Unfair Competition Law in the country has been the dissemination of misleading information.

In 2024, the AMCU focused on identifying the dissemination of misleading information across three markets: mineral waters, dietary supplements, and cosmetic products. It is worth noting that the threshold for proving misleading information in Ukraine is relatively low, as the applicable legal test in Ukraine is based on the perspective of an average, unskilled consumer – someone who is presumed not to verify the accuracy of commercial claims and who relies primarily on their overall first impression.

Informational Violations

In 2024, the AMCU continued its active efforts to combat so-called informational violations – i.e., providing false, inaccurate, or incomplete information to the regulator in response to its request, or failing to submit the requested information altogether. The regulator reviewed 312 cases of informational violations in 2024, with the most common being the failure to submit the requested information.

Nord Stream 2 Project–Related Case

The case stemmed from the AMCU’s investigation into alleged anti-competitive agreements related to the Nord Stream 2 project (Project). The AMCU launched an investigation back in 2021, suspecting a gun-jumping violation committed by the Project participants – specifically, the failure to obtain prior concerted practice clearance from the regulator. As part of the investigation, the AMCU sent the requests to the Ukrainian subsidiaries of: (1) Engie Energy Management Holding Switzerland AG (Engie), (2) Shell Exploration and Production (LXXI) B.V. (Shell), and (3) Wintershall Nederland Transport and Trading B.V. (Wintershall) requesting to confirm or deny conclusion of any agreements related to the Project.

According to the AMCU, none of the entities submitted information to the regulator, preventing the latter from exercising its discretionary powers – in case at hand, determining whether the participants in the Project were required to obtain prior clearance. As a result, the AMCU imposed fines on the Ukrainian subsidiaries of Engie, Shell, and Wintershall. Shell’s subsidiary received a fine of UAH 43 mln. (approx. EUR 0.9 mln.) – the largest fine ever imposed by the AMCU for an informational violation. All three entities challenged the AMCU’s decision in Ukrainian courts.

In March 2025, Wintershall’s Ukrainian subsidiary won the case before the Ukrainian Supreme Court. The central question in this case was whether Ukrainian entities belonging to foreign corporate groups can be held liable for failing to provide the regulator with the requested information that is in the possession of another entity within the same corporate group. The Supreme Court ruled that holding a Ukrainian entity liable for not providing information held by a foreign affiliate would violate the principle of fairness in legal liability. Furthermore, it emphasized that corporate affiliation alone does not justify extending the AMCU’s enforcement powers beyond Ukraine’s jurisdiction.

AMCU Started Targeting Digital Markets

Jumping ahead, digital markets have been identified as the AMCU’s top enforcement priority for 2025. In fact, the regulator began moving in this direction as early as 2024, issuing recommendations to two tech-related companies operating in different areas of the digital economy.

Kyiv Digital

In early 2024, the AMCU issued recommendations to the municipal company behind the Kyiv Digital app – a multifunctional platform offering various services, including payments for transport ticketing and parking fines. The AMCU expressed concerns that users faced commission fees of up to 10%, with no access to alternative payment service providers (PSPs) that could offer more competitive rates. To address these concerns, the regulator issued recommendations to the municipal entity administering the app to promote competition by enabling the integration of additional PSPs on transparent, clear, and non-discriminatory terms.

BlaBlaCar

Later in the year, the AMCU turned its attention to BlaBlaCar, identifying the platform as likely dominant in the narrowly defined market of ”carpooling services via online platforms in Ukraine”, citing its market leadership and lack of substantial competition from rivals. The regulator alleged that BlaBlaCar applied unjustified service fees to passengers and maintained inconsistent refund policies when passengers canceled rides. The AMCU recommended that the company adopt a transparent methodology for fee calculation and implement a fair and non-discriminatory refund policy.

Legislative Developments and EU Integration

Last year, the AMCU remained actively engaged in supporting Ukraine’s EU integration efforts. As part of the second phase of the Ukrainian competition law reform, the regulator developed legislative proposals aimed at strengthening its institutional capacity and providing more effective tools for enforcing competition law. Notably, the proposals introduce administrative liability for companies and government officials who obstruct dawn raids, fail to submit requested information to the regulator, or ignore official summonses to appear and provide explanations.

On the international front, the AMCU took significant steps toward obtaining associate membership in the OECD Competition Committee, further aligning Ukraine’s competition framework with global best practices, including implementation of the OECD Recommendations on Competitive Neutrality. Throughout the year, the regulator also cooperated with the European Commission on competition policy, holding bilateral meetings as part of the official screening process to assess the alignment of Ukrainian legislation with EU law.

First-Ever Leniency Case

2024 marked a milestone for Ukraine’s antitrust enforcement with the first-ever application of the updated leniency procedure by the AMCU. Although leniency provisions had been part of Ukraine’s competition law since 2002, their effectiveness had long been hindered by the lack of clear procedural guidance. A significant shift occurred with the entry into force of competition law amendments on 1 January 2024, accompanied by the adoption of the respective procedure by the AMCU.

Ukraine’s updated leniency procedure brings greater clarity and alignment with EU standards. It offers full immunity from liability to the first applicant, while subsequent applicants may receive fine reductions of up to 50%, 30%, or 20%, respectively. Applications can be submitted even after an investigation has started, as long as they are filed before the AMCU issues its preliminary conclusions.

In December 2024, the AMCU applied the updated leniency procedure in a bid-rigging case involving two public procurements. One company received full immunity after providing information about the violation to the regulator, submitting key evidence and fully cooperating. The second company, which did not cooperate, was fined 2% (the maximum statutory fine of up to 10%) of its annual turnover for each of the two bid-rigging violations committed.

State Aid

To recall, Ukraine introduced a state aid regime in alignment with EU acquis under the EU-Ukraine Association Agreement in 2014. The regulatory framework, effective from 2 August 2017, is based on the law of Ukraine “On State Aid to Undertakings” (State Aid Law) and secondary legislation.

Following the full-scale invasion by Russia, Ukraine introduced martial law, leading to a temporary suspension of state aid control, effective from March 2022. Since then, state aid grantors have been exempted from the obligation to notify the AMCU of new or amended aid measures – these measures are automatically deemed compatible with domestic competition rules.

In 2024, the AMCU prepared a draft law aimed at introducing liability and penalties for state aid grantors, particularly those who grant unlawful or incompatible state aid. In line with its obligations under the EU-Ukraine Association Agreement, the AMCU conducted a partial inventory of existing schemes and compiled a list of potential state aid measures requiring compliance with the State Aid Law. Grantors must align these schemes with the law and its compatibility criteria. Non-compliant schemes will be terminated.

AMCU’s Top Priorities for 2025

In its 2024 report, the AMCU highlighted the following markets and industries its top enforcement priorities for 2025:

Figure 4. AMCU’s Top Priorities for 2025

The AMCU also highlighted in its report that identifying bid-rigging violations in the following sectors will remain a top priority in the upcoming year: defense, healthcare, and construction. Another key priority for the AMCU in 2025 will be enhancing its institutional capacity, including harmonizing Ukrainian competition law with EU standards, continuing cooperation with the OECD, and further strengthening the AMCU’s powers in bid-rigging investigations.

Outlook for 2025

Despite the ongoing challenges of wartime, we expect the AMCU to remain fully operational and increasingly active in 2025. The regulator is likely to issue a greater number of decisions, impose higher fines, and commence new investigations and sector inquiries.

We do not anticipate a decline in the average number of merger control notifications reviewed by the AMCU. Over the past five years, this number has consistently ranged between 450 and 550. Given the AMCU’s growing focus on identifying gun-jumping violations, we strongly recommend that foreign counsel assess carefully whether a transaction is notifiable and ensure timely notification when required.

Finally, we expect the AMCU’s increasing interest in digital markets to translate into more assertive enforcement. The regulator has clearly identified digital platforms as its top enforcement priority for 2025. Accordingly, we anticipate a rise in investigations involving tech companies operating in a digital economy.

[1] This means that if a transaction involves the acquisition of multiple direct targets – rather than a single holding company consolidating them – there may be multiple separate filings for the same overall deal. As a result, the statistics may be distorted, and the actual number of distinct deals could be lower than the number of filings suggests.

[2] The exceptionally low fine was because the transaction qualified for a special procedure available during the initial months of the war (February–June 2022), under which only nominal fines were imposed in cases where the parties filed and closed the transaction before obtaining the clearance.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.