Below we cover the main competition law developments in Spain in 2024, concerning (i) institutions and legislation, (ii) antitrust, (iii) mergers and (iv) State aid.

Institutions and Legislation

Teresa Ribera Joins the European Commission as Executive Vice-President and Commissioner for Competition

On 27 November 2024, the European Parliament confirmed Teresa Ribera as the Executive Vice-President (‘EVP’) of the European Commission for a Clean, Just and Competitive Transition, and as the new Commissioner for Competition. EVP Teresa Ribera therefore substituted Margrethe Vestager, who had served as Competition Commissioner for a record two consecutive terms since 2014 and as EVP of the European Commission since 2019.

Before joining the Commission, EVP Teresa Ribera was the third Vice-President of the Spanish government and Minister for ecological transition and demographic challenge, as a member of the Spanish Socialist Workers’ Party. On 17 September 2024, Teresa Ribera was designated by President Ursula Von der Leyen, who announced on that date the structure and members of her new Commission for the upcoming 5-year term.

EVP Teresa Ribera’s portfolio contains a large set of responsibilities, as displayed in her Mission Letter and at the confirmation hearing held in the European Parliament’s on 12 November 2024 (the full transcript of the hearing is available here). As EVP for a Clean, Just and Competitive Transition, she is responsible for keeping Europe on track with the goals set out in the European Green Deal. This combination of responsibilities reflects the idea of a “decarbonized and circular economy”, advocated by Mario Draghi in his Report (Part A, pp. 10 and 35-38), and involves coordinating efforts with the Vice-President for Prosperity and Industrial Policy on the Clean Industrial Deal, achieving emission-reduction targets in 2030 and beyond, reducing high energy prices, and directing investment and financing towards a just and social transition.

EU competition policy and enforcement also represents a large portion of EVP Teresa Ribera’s portfolio, which responds to a new approach aimed at better supporting companies expanding in global markets while ensuring a level playing field – an idea reflected both in President Von der Leyen’s Political Guidelines for the European Commission (p. 7) and in the Draghi Report (Part B, pp. 298-299). This underlying principle has crystallized in specific priorities displayed in EVP Teresa Ribera’s Mission Letter, such as:

- simplifying State aid rules while avoiding a subsidy race between Member States;

- reviewing the Horizontal Merger Control Guidelines to give adequate weight to resilience, efficiency and innovation;

- closing the gap on killer acquisitions from foreign companies;

- strengthening and accelerating the enforcement of competition rules on the most distortive aids and practices;

- enforcing the Foreign Subsidies Regulation, with a special focus on the rules applicable to mergers; and

- addressing economic power in the digital markets, in particular by opening up locked ecosystems, increasing consumer choices and protecting the capacity of both business users and consumers to make full use of the data that they have generated.

EVP Teresa Ribera also recognized that a new ex ante competition tool to identify and tackle structural problems in certain markets merited an in-depth understanding, while acknowledging that there are already in place tools that follow a similar approach, such as the DMA.

The CNMC and the European Commission Sign a Memorandum of Understanding to Further Enhance Their Cooperation in DMA Enforcement

On 6 June 2024, the Spanish Competition Authority (‘CNMC’) and the Commission signed a Memorandum of Understanding (‘MoU’) that will allow officials from both authorities to combine resources and create joint investigation teams in cases where the DMA affects the Spanish market (available here).

This MoU represents a further step in the cooperation between both institutions in the enforcement of the DMA, which was already crystallized last year by a reform to the Spanish Competition Act. In particular, the Spanish Royal Decree-Law 5/2023 empowered the CNMC to carry out investigations of potential violations of the DMA in Spain, as foreseen in Article 38(7) DMA (see D. Pérez de Lamo, B. Martos Stevenson, M. Victoria Paredes Balén, “Main Developments in Competition Law and Policy 2023 – Spain”).

The Spanish Constitutional Court Confirms that Article 101 TFEU Is a Rule of Public Order

In a judgment rendered on 2 December 2024, the Spanish Constitutional Court (‘SCC’) clarified that EU law provisions declared as rules of public order by the Court of Justice of the EU (‘CJEU’) in Ecoswiss (C-126/97) and its progeny – including Article 101 TFEU – have the same consideration under the Spanish legal system, and that the misapplication of these rules in arbitration proceedings can constitute a ground for the annulment of the award (STC, recurso de amparo nº 921-2022).

The case involved Cabify and Auro, both companies active in the provision of transportation services. In February 2017, Auro agreed to offer its transportation services exclusively through Cabify’s digital platform. The parties later had a contractual dispute concerning certain provisions, including the exclusivity clause, and therefore submitted the controversy to arbitration. In December 2020, the Court of Arbitration of Madrid ruled in favor of Auro and concluded that the exclusivity clause restricted competition by object and therefore was void. Cabify later submitted an action of annulment of the award before the Madrid Court of Appeal (‘MCA’), which upheld the action finding that the award only considered the Spanish Competition Act and failed to apply Article 101 TFEU, a rule of public order.

On 11 February 2022, Auro filed a recurso de amparo before the SCC, alleging that the MCA had violated its rights of defense insofar the MCA had exceeded its jurisdiction when it annulled the award. In its judgment, the SCC confirmed the principle that Article 101 TFEU is a rule of public order under the Spanish legal system, like any other EU law provision declared as such by the CJEU, and therefore its misapplication constitutes one of the exceptional grounds for setting aside an award (as established in Article 41(1)(f) of the Spanish Arbitration Act). However, the SCC also found that the court of arbitration had actually applied Article 101 TFEU correctly and, therefore, that the MCA had erred in setting aside the award.

Spain Transposes Directive 2020/1828, Implementing Changes to Collective Actions

In March, the Council of Ministers approved the government´s draft of a new Organic Law aimed at modernizing the legal procedure of collective actions and the Court system. The proposed draft amends several aspects of the provisions governing collective actions. It introduces a unified procedure for damages, establishing the conditions under which consumers´ associations may initiate and participate in proceedings. The proposed procedure adopts the “opt-out” model in which consumers are presumed to be part of the action unless they decide otherwise, replacing the prior “opt-in” regime. In addition, the draft foresees the creation of a public registry for these actions, facilitating knowledge by the consumers of existing actions and allowing them to channel their claims through the system. Under the new system, if an action is successful, all claimants will have their claims automatically validated. These amendments form part of the Spanish Government´s late efforts to transpose Directive (EU) 2020/1828, the transposition period of which ended almost two years ago. The final draft is expected to be passed into law by the Congress of Deputies in the coming weeks.

Antitrust

The CNMC Fines Booking.com for Abusing its Dominant Position

In July 2024, the CNMC fined Booking.com c. EUR 413 million for allegedly abusing a dominant position on the basis of a market the CNMC identified as covering the provision of online booking intermediation services to hotels by Online Travel Agencies (‘OTAs’), the highest fine ever imposed by the CNMC to a single company (Booking – S/0005/21). The CNMC concluded that Booking.com committed two different types of abuse since at least January 2019, and imposed fines of c. EUR 206 million for each alleged abuse. The CNMC also imposed several behavioral remedies on Booking.com to prevent similar conduct in the future.

According to the decision, Booking.com imposed unfair commercial conditions to hotels located in Spain, notably, preventing them from offering their rooms on their own websites at better prices or conditions than those offered on Booking.com’s platform – a so-called “narrow parity clause” – while reserving Booking.com’s right to unilaterally compete on price for offers available through Booking.com. In addition, Booking.com’s standard terms allegedly led to hotels located in Spain facing “unequal” litigation costs because they were subject to Dutch law and courts. Finally, the CNMC also claimed that Booking.com provided insufficient information regarding the benefits for hotels of adhering to its optional premium programs. The CNMC concluded that these practices constituted an exploitative abuse of its dominant position, thus infringing Article 2 of the Spanish Competition Act and 102 TFEU.

The CNMC also alleged that Booking.com engaged in an exclusionary abuse of dominance by ranking prominently in certain search results hotels that performed well on Booking.com – i.e., hotels that obtained more bookings or provided for higher profitability in terms of commission. The CNMC argued that using such performance criteria in ranking restricted Booking.com’s competitors from expanding in the market. Finally, the CNMC alleged that the eligibility criteria for participating in Booking.com’s premium programs were based on hotels’ performance on the platform and that this caused hotels to prioritize Booking.com at the expense of other competing platforms.

The CNMC decision – currently under appeal to the Spanish National Court (Audiencia Nacional) – may also test aligning national enforcement with the DMA’s obligations. The DMA – a regulation enacted to promote a single digital market in the European Union – covers some of the issues at stake in the CNMC decision. Specifically, as a gatekeeper, Booking.com is now prevented from requiring parity conditions in the EEA (Article 5(3) DMA). While the European Commission has exclusive competence to interpret and apply this DMA provision, this same issue appears to have now been assessed by the CNMC in its decision.

The CNMC Probes Apple for a Possible Anticompetitive Conduct in the Distribution of Apps on its Devices

On 24 July 2024, the CNMC opened infringement proceedings against Apple for a possible abuse of its dominant position in the distribution of applications for its devices (see the CNMC Press Release of 24 July 2024). According to the press release, Apple may have imposed unfair commercial conditions on developers using its App Store to distribute applications to users of Apple products. Although the press release does not describe the content of the commercial conditions being investigated, previous and ongoing investigations carried out by the Commission suggest that they may relate to the imposition of anti-steering provisions on its app developers. For context, on 4 March 2024, the Commission fined Apple over EUR 1.8 billion for imposing anti-steering provisions to music streaming app developers, which prevented them from informing users of Apple products about alternative and cheaper music subscription services that were available outside the music app (see the Commission Press Release of 4 March 2024). On 25 March 2024, the Commission also opened a non-compliance investigation against Apple for a possible infringement of Article 5(4) DMA, which also requires gatekeepers to allow app developers to communicate consumers offers outside the gatekeepers’ app stores, free of charge (see the Commission Press Release of 25 March 2024).

This is not the first time that Apple faces an antitrust procedure before the CNMC. Last year, the CNMC already fined Apple and Amazon for restricting the resale of Apple (and competing) products on Amazon’s website in Spain (see D. Pérez de Lamo, B. Martos Stevenson, M. Victoria Paredes Balén, “Main Developments in Competition Law and Policy 2023 – Spain”). This sanction has been appealed before the Spanish National Court (Audiencia Nacional) and the payment of the fine has been suspended.

The Spanish Commercial Court Issues Ruling in European Super League

On 27 May 2021, the Commercial Court No 17 of Madrid requested a preliminary ruling from the EU Court of Justice (see request and English translation) on whether FIFA-UEFA’s prior approval rules of interclub football competitions breach Articles 101 and 102 TFEU. The practices and broader context leading to this request has been discussed previously (see D. Pérez de Lamo, X. Quer Zamora and C. Rubio Bañeres, “Main Developments in Competition Law and Policy 2021 – Spain”). As is well-known by now, on 21 December 2023, the Grand Chamber of the Court of Justice delivered its preliminary ruling in European Superleague (C-333/21), finding in essence that FIFA-UEFA’s pre-authorization rules were contrary to EU law because (i) FIFA-UEFA, as a dominant undertaking participating in the market for the organization of interclub football competitions, also had the power to regulate access to it and (ii) FIFA-UEFA’s pre-authorization criteria were not transparent, objective and non-discriminatory, and the sanctions ensuing therefrom were not proportionate. Following the preliminary ruling, the Commercial Court No 17 of Madrid held a hearing and, on 24 May 2024, issued its judgment, echoing the EU Court of Justice’s findings. On 21 June 2024, UEFA adopted its new Authorisation Rules governing international club competitions. And in December 2024, A22 Sports Management, the company behind the European Super League, relaunched the project as the “Unify League” (see details here). The battle for the organization of European football competitions will thus continue…

RENFE under Investigation for Alleged Bid-Rigging

In July, the CNMC announced that it was investigating Renfe, the State-owned national railway operator, for alleged bid-riding (S/0010/23 – PECOVASA). In 2022, Pecovasa, a RENFE subsidiary dedicated to the rail transport of cars, opened a tendering process for the provision of traction to its freight trains, which was later won by Renfe Mercancías, RENFE´s freight subsidiary. An association representing a number of privately-owned railway freight operators filed a complaint with CNMC. The authority carried out dawn-raids on both RENFE subsidiaries and their head company in October 2023.

The CNMC now has 24 months to complete its investigation. This is just the latest in a number of run-ins between RENFE and competition authorities in the last few years. In January 2024, the Commission accepted RENFE´s commitments in the online rail ticketing market, after the European authority had launched a formal investigation (Case AT.40735) into RENFE’s allegedly abusive behavior in the market.

SGAE’s “Flat Rates” Are Abusive

On 26 June 2024, acting on a complaint filed by entities Derechos de Autor de Medios Audiovisuales, Entidad de Gestión (Dama) and Unison Rights, S.L. (Unison), the CNMC fined Sociedad General de Autores y Editores (SGAE) with EUR 6.4 million for abusing its dominant position by designing “averaged availability rates” (comparable to a flat rate) for all radio and the large majority of television operators in order to use SGAE’s repertoire (Dama-Unison Rights vs SGAE S/0641/18, see Press Release). According to the CNMC, the SGAE’s flat rates constituted (i) an exploitative abuse, insofar they forced radio and television operators to pay excessive rates that were disconnected from the effective use of the repertoire and (ii) an exclusionary abuse, insofar they discouraged radio and television operators from contracting with SGAE’s competitors. The CNMC found that, with regard to musical works, the exclusionary effect was reinforced by SGAE’s conduct of presenting its musical repertoire to users as universal and offering indemnity guarantees against possible claims by third parties for the use of rights not belonging to its repertoire.

Mergers

Spanish Merger Statistics (2024)

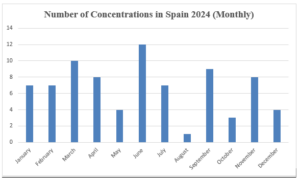

The CNMC reviewed a total of 80 concentrations in 2024, spread monthly as follows:

2024 was an average year in terms of transactional activity (see full list). Although it represents an increment over 2023 (72 concentrations, a 13% increase) it is still far from the record 108 concentrations that the CNMC reviewed in 2021 (see D. Pérez de Lamo, B. Martos Stevenson, V. Paredes Balén, “Main Developments in Competition Law and Policy 2023 – Spain”).

The CNMC authorized most concentrations in phase I without commitments (72); a minority of concentrations in phase I with commitments (7) or in phase II with commitments (1); and closed one administrative procedure. The three concentrations authorized in phase I with commitments were Damm-Idilia / Cacaolat (C/1495/24), CASP-MCH/Druni/Arenal (C/1456/24), Cepsa / Ballenoil (C/1463/24), Indigo / Parkia (C/1452/24), Hospitales Cogasa / Centro Medico El Carmen (C/1438/24), QSI/WPT (C/1430/23), BSC / Activos B. Braun (C/1421/23). The concentration authorized in phase II with commitments was Smurfit Bulgaria / Artemis BIB (C/1424/23). The abandoned transaction was JCDecaux España / Clear Channel España (C/1426/23). As of year´s end, one Phase II investigation is still ongoing, BBVA / Banco Sabadell (C/1470/24).

The CNMC Analyzes BBVA’s Takeover of Banco Sabadell

On 31 May 2024, BBVA notified its intention to acquire Banco Sabadell to the CNMC (BBVA / Banco Sabadell C/1470/24). BBVA, Spain´s second largest lender, had launched earlier in the year a takeover bid over Banco Sabadell, the country´s fourth largest lender and a significant source of financing for SMEs’. Both BBVA and Banco Sabadell have been categorized as Significant Institutions and therefore fall under the direct supervision of the European Central Bank.

After a considerable delay, on 12 November, the CNMC announced the launch of a Phase II investigation into the transaction. The delay was caused by Banco Sabadell´s belated responses to several requests for information from the authority. In its decision the CNMC determined that the transaction raises concerns on three areas: (i) Retail Banking (concerns that the transaction would impose less favorable terms and conditions for consumers and SMEs and that BBVA would likely close branches post-merger, particularly in rural areas); (ii) Payment Services (concern that after acquiring Sabadell´s sizable payment services business BBVA would impose higher commissions, particularly on SMEs) and (iii) Cash Machines (concern that Sabadell´s clients would see the number of cash machines they can access reduced, due to a curtailment of existing agreements with other banks after the transaction).

In order to alleviate the CNMC´s concerns BBVA offered several commitments. Regarding Retail Banking, BBVA committed to maintain Sabadell´s contractual terms in those areas in which a duopoly or a monopoly would result post-transaction, and BBVA proposed additional commitments for SMEs and consumers deemed financially vulnerable. Moreover, BBVA committed not to close any branches in rural or impoverished areas, and not to close any offices servicing SMEs. In regard to Payment Services and Cash Machines, BBVA offered to divest any excess participation in companies that manage payments, as well as a guarantee that all of Sabadell´s existing agreements with other banks will remain in place for 18 months, ensuring continued access to cash machines for existing Sabadell customers.

The CNMC deemed these commitments as insufficient, alleging that they did not fully address the concerns raised by the transaction and, therefore, opened a Phase II investigation.

The CNMC Fines Rheinmetall for Providing Misleading Information in a Merger Proceeding

On 30 April 2024, the CNMC fined Rheinmetall with EUR 13 million for concealing data and providing misleading information in the context of its acquisition of Expal Systems (Rheinmetall – SNC/DC/081/23).

On 2 February 2023, Rheinmetall and Expal Systems, both companies active in the defense industry, notified the transaction without identifying any horizontal or vertical overlaps, and this led the CNMC to authorize the transaction in less than a week. However, Roxel, a customer of the parties, appealed the CNMC clearance decision and outlined the risks that the transaction would create in the wet pulp market. Following this claim, the CNMC initiated an investigation and found that Rheinmetall had concealed relevant data and provided misleading information.

The CNMC first found that Rheinmetall did not identify the markets for the sale of nitrocellulose and wet pulp in the filing form, which are used as inputs in the production of propellants. Both parties were active in those markets at the time of the filing and therefore had the obligation to identify them in the form. The CNMC also found that Rheinmetall failed to provide accurate information when replying to the request for information sent by the CNMC before formally opening the infringement proceedings. Rheinmetall implied that its activity in the nitrocellulose and wet pulp markets was not substantial, whereas the CNMC found that the sale of those products involved a regular activity of both parties, which had very high shares.

According to the CNMC decision, both conducts implied an obstruction of the CNMC work and were therefore qualified as a serious infringement, which can be fined up to 5% of the undertakings’ worldwide turnover. In the present case, the CNMC fined Rheinmetall with EUR 6.5 million for each infringement, equivalent to 0.07% of its worldwide turnover.

The adoption of this decision – now appealed by Rheinmetall – raises several questions. A first issue arises as to whether the decision contravenes the principle of legality as regards the first infringement. While Article 62(3)(c) of the Spanish Competition Act clearly establishes that providing misleading information in a response to a request for information constitutes a serious infringement, it does not state the same for providing misleading information in the filing form. This may lead the Spanish High Court of Appeal (‘SHCA’) to conclude that the first of the fines imposed has no legal basis and annul that part of the decision. For the time being, the SHCA has temporarily suspended the payment of the fine pending final judgment (AAN 7432/2024, only available in Spanish).

A further consideration relates to the consequences that derive from the clearing decision itself to the extent that it is based on misleading information. Unlike the EUMR, the Spanish Competition Act does not expressly allow the CNMC to dissolve mergers in cases where these have been approved on the basis of incorrect information. In this way, this case reveals another shortcoming in the Spanish Competition Act that should be addressed in the future.

In addition to Rheinmetall, the CNMC concluded a series of infringement proceedings in the merger context in 2024:

- the CNMC fined two undertakings for failing to comply with the commitments offered in their respective merger proceedings (Mooring Port Services / Cemesa Amarres Barcelona SNC/DC/065/23, see Press Release and Naviera Armas / Trasmediterránea SNC/DC/083/23, see Press Release); and

- the CNMC terminated infringements proceedings against two providers of cancer-treatment services, an electricity provider and a maritime transport company after the undertakings admitted to gun jumping and paid the fines in advance (KKR Genesis / GeneraLife SNC/DC/077/23, see Press Release; Generalife Clinics / Ginemed SNC/DC/082/23, see Press Release; and Marcial Chacón e Hijos / Electra la Honorina SL – Decail Energía SNC/DC/057/24, see Press Release.

State Aid

Spanish Court Sees Indirect Challenge to a Commission´s Decision Approving the Use of State Funds to Cap Energy Prices

In 2022, European energy prices skyrocketed as a consequence of Russia’s aggression towards Ukraine. The Spanish government, in an effort to curve the increase in prices, developed a scheme by which State funds would be used to partially cover the costs incurred by energy companies when purchasing fossil fuels, effectively capping prices of electricity in the wholesale market. The European Commission approved the scheme, known as the “Iberian Exception”, affirming that it was compatible with State aid rules (SA.102454). The scheme resulted in noticeably lower energy prices in Spain and Portugal compared to other Member States.

Several undertakings filed an action of annulment of the Commission Decision approving the scheme in 2022 (pending case RH and Others v Commission T-596/22). In parallel, the undertakings challenged the Spanish instrument to implement the measure, Royal Decree-Law 12/2022, before the Spanish National Court (Audiencia Nacional). In this national proceeding, the applicants argued that the Commission failed to properly analyze the State aid nature of the scheme and that it is disproportionate, affecting the applicants’ ability to compete given the divergence in energy costs. In addition, the applicants alleged that the Iberian Exception is discriminatory, that it breaches legitimate expectations and that an alternative, less harmful measure, could have been adopted. In September 2024, the oral hearing took place and a judgment is expected in the coming months.

The views expressed are our own and do not reflect the views of our employer/firm.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.