5 Key Takeaways

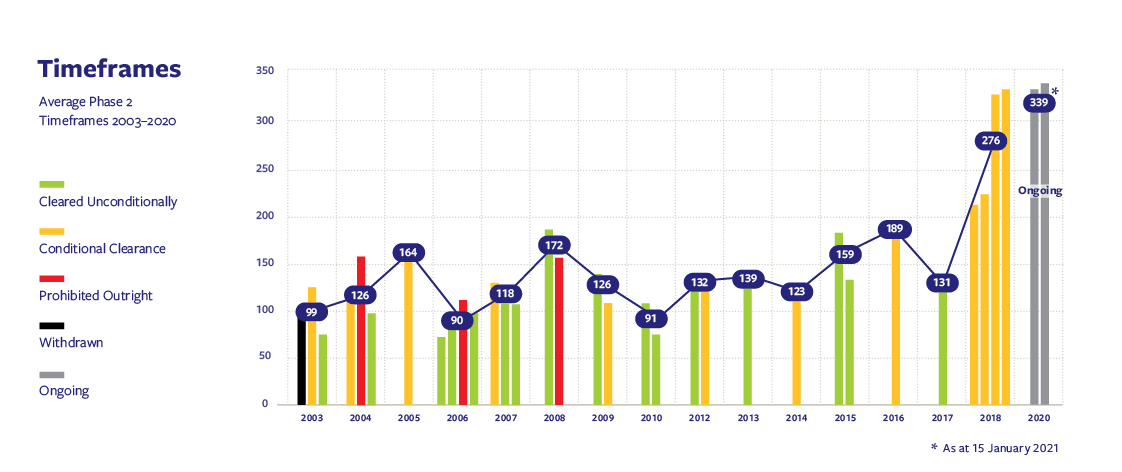

- More Deals Take Longer

More deals than ever before involved extended CCPC reviews. Of 42 deals notified, 10 involved merger review delays of at least 3 months. Two “Phase 2” reviews, both on going as of 15/01/2021, have each taken 11 months already. According to the CCPC, this trend reflects “the complex nature” of deals notified, not COVID-19. But every 2020 deal has cleared unconditionally so far.

- COVID-19 Challenges Met

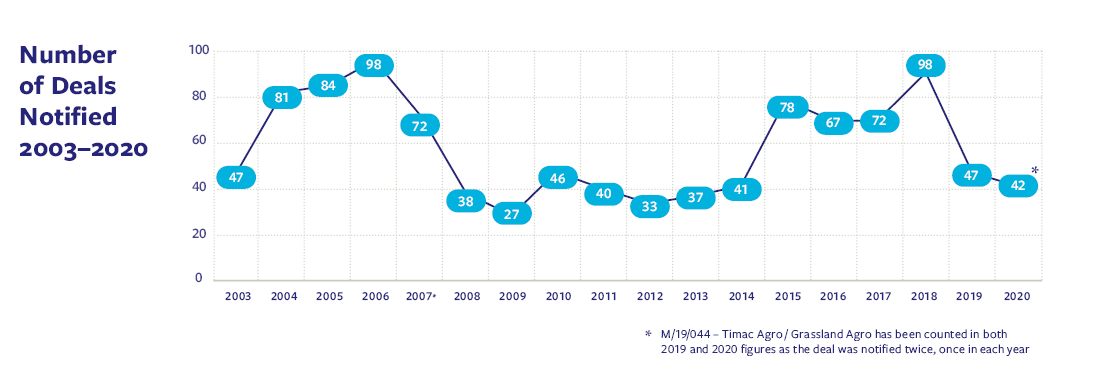

The CCPC adapted successfully to COVID-19 challenges, even while there was little slowdown in the pace of filings, with a total year-on-year drop from 47 to 42. E-filings, online state-of-play meetings and remote oral hearings are now part of CCPC procedures. The CCPC engaged constructively in agreeing to pause reviews for additional information and even managed to conduct a (COVID-19-compliant) site visit. To its credit, the CCPC also successfully deployed a new “simplified” filing system for no- or limited-overlap deals.

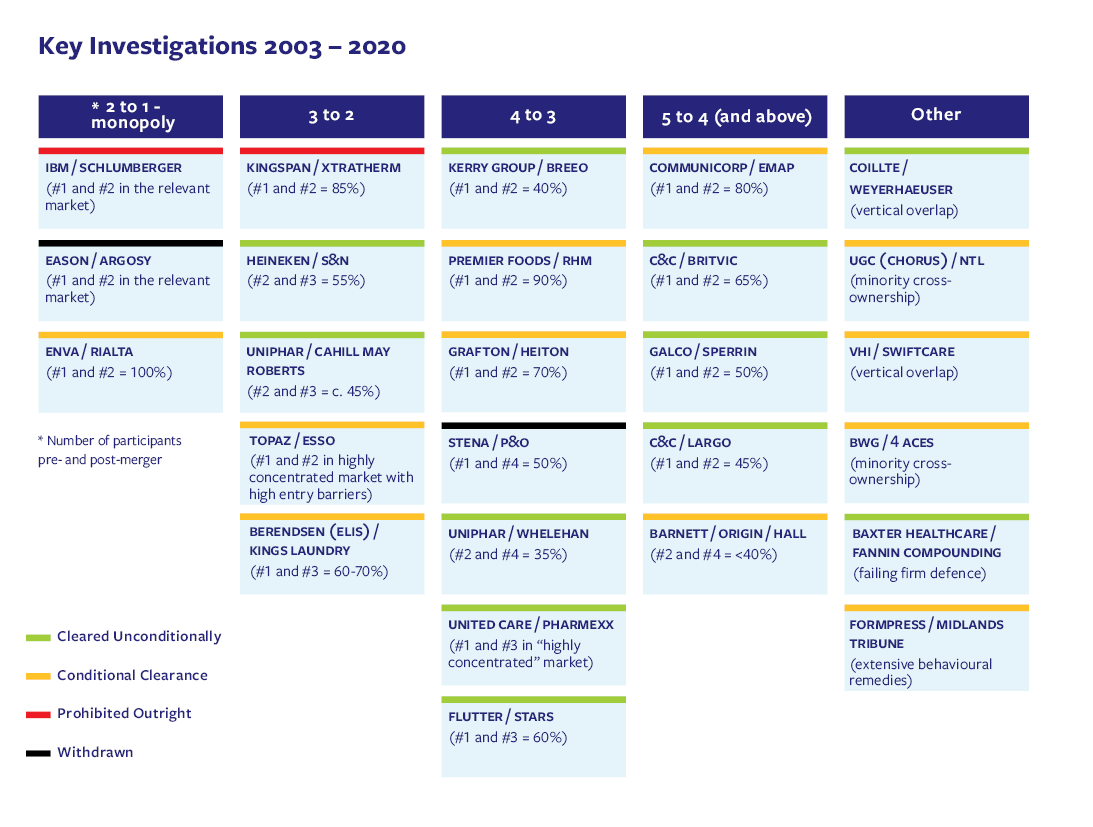

- No Special Scrutiny of On-Line Concentration

A 4-to-3 deal between two on-line gambling providers, with the combined entity holding 55 – 60% market share, was cleared unconditionally after a 3-month review. In Flutter Entertainment plc’s acquisition of Canadian online gambling company The Stars Group Inc., the CCPC relied on Google AdWords data to assess closeness of competition between them. In another case, an unusual “voluntary” filing of Eason’s acquisition of rival book retailer Dubray, the CCPC cited COVID-19 shifts to on-line purchases as compelling evidence that online and bricks-n-mortar retailers are direct competitors.

- New Fast-Track Procedures for “Simple” Deals Are An Immediate Success

On 1 July, the CCPC inaugurated a simplified procedure for deals involving no- or limited-overlap. Of the 23 deals notified since, 8 benefitted from this new procedure (albeit that, in one case, the CCPC reverted to a standard review procedure following receipt of a 3rd party complaint). In the other 7 “simplified” deals, CCPC approval issued rapidly within an average of 13.4 working days of filing.

- Media Mergers Watch Out!

The definition of a “media merger” continues to be interpreted broadly in the era of online media, giving rise to a large category of deals to which special merger rules apply, whatever the turnover or size of the parties involved. Greencastle’s high-profile acquisition of Joe.ie and Her.ie owner Max Media, which the CCPC decision says provides “online tech, sport, casual news and entertainment for the 18-30 age cohort,” was considered a media merger by the CCPC. Similarly, acquisition by a UK operator of online sports news websites and social media accounts, Rocket Sports Internet Limited, of online sports news website www.benchwarmers.ie was considered a media merger (as was the acquisition of Benchwarmers in 2017).

Things to Watch in 2021

- New Foreign Investment Screening Rules

Ireland is to adopt a foreign investment screening regime in 2021, adding a new layer of review for some transactions. While a draft of the Investment Screening Bill has not yet been published, the Government has confirmed new powers to “assess, investigate, authorise, condition, prohibit or unwind foreign investments” are on the horizon. How the investment screening regime will interact with the CCPC’s merger review process remains to be seen.

- New CCPC Enforcement Powers

The Government is also proposing to grant the CCPC new powers, including (i) to order unwinding of non-notifiable deals that substantially lessen competition, (ii) to take summary gun-jumping prosecutions, (iii) the power to force parties not involved in the merger to provide it with information on affected markets, and (iv) to issue interim hold-separate orders for voluntarily notified deals. The CCPC is also set to push to make early implementation of a notified deal a criminal offence, in addition to failure to notify.

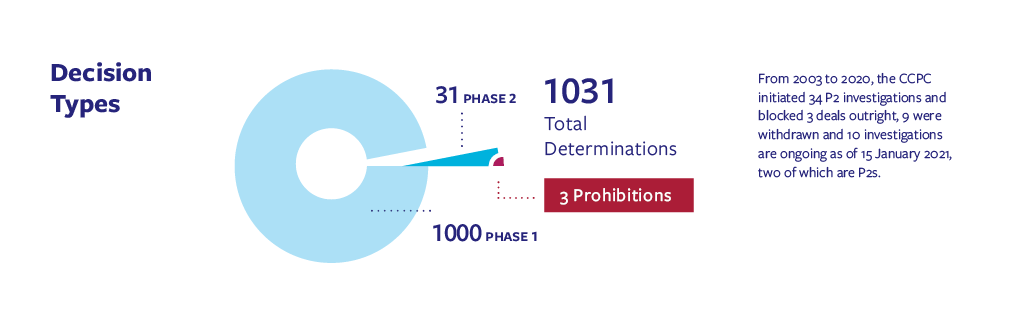

By the Numbers

116 – The number of days the average extended Phase 1 clearance decision took in 2020, in other words over 16 weeks or around 4 months.

27% – The percentage increase in the size by staff numbers of the Mergers & Competition Enforcement Division within the CCPC in 2020. The CCPC says it is preparing “for the potential increase in complex mergers which Brexit may bring.

0 – The number of deals prohibited or subject to conditional approval in 2020.

67% – The percentage increase in the number of deals involving extended CCPC investigations from 2019 to 2020. The biggest single-year increase on record.

> 400% – The total number of merger interventions by the UK regulator compared to the Irish CCPC in the past 5 years.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.