Summary

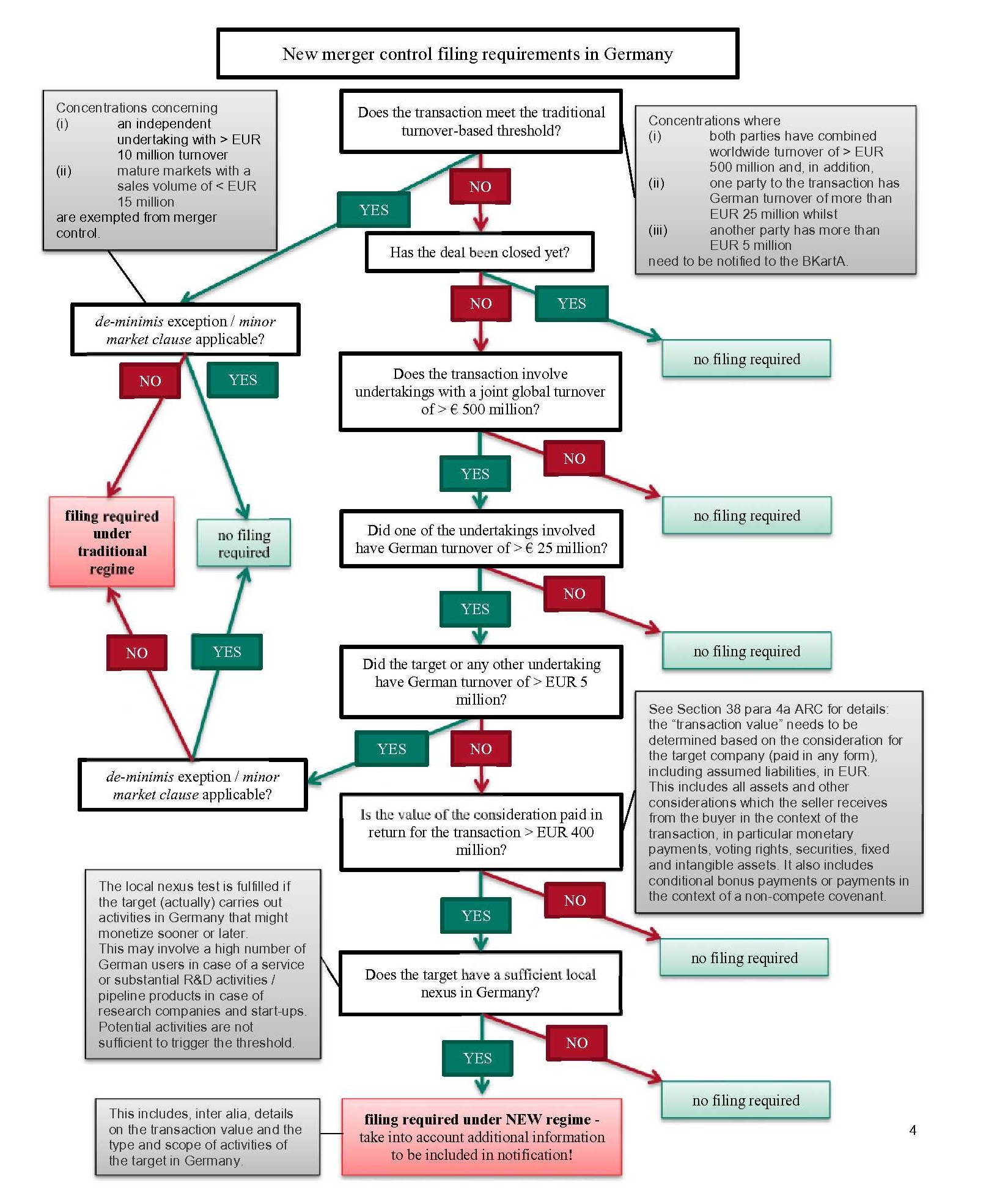

- New German threshold for high value but no/low German sales transactions to enter into force: Imminent changes to merger control will widen jurisdiction to catch (i) high value transactions worth over EUR 400 million with (ii) target substantial German activity even where (iii) the deal would previously not have been notifiable because the target’s revenues were less than EUR 5 million.

- No transitional provisions. The new rule catches deals signed, but not yet closed, prior to the law’s adoption. It is important to check whether the new merger control rules may apply to current deals.

- What is “substantial activity”: potentially notifiable deals will require close scrutiny of how to assess whether the targets are “significantly active” in Germany. This note provides guidance as to how deals should be assessed.

Introduction

The new German merger control threshold may enter into force any day and may capture transactions that have not been closed by that time. Companies should be aware of this obligation but also know when they can escape a filing requirement.

The new threshold

On 31 March 2017, the German Federal Council (Bundesrat) adopted the ninth amendment to the Act against Restraints of Competition (ARC) (Gesetz gegen Wettbewerbsbeschränkungen). The amendment will, inter alia, introduce an additional, transaction-value based merger control threshold. This threshold is intended to capture deals that – despite the low turnover figures of the target company – may have a significant impact on competition in the future. Transactions in the high-tech and digital economy and innovation-driven industries such as pharmaceuticals are in the focus.

Timing – no transitional period!

For companies, it is crucial to know that the new threshold is foreseen to enter into force on the day following the publication of the law in the Federal Gazette, without any transitional arrangement. Publication was already expected to occur in April and may therefore happen any day. This means that companies have to expect new filing requirements in Germany, that may potentially affect their ongoing (i.e. all “unclosed”) transactions “over night”.

So what does this mean for companies that are currently considering or already planning transactions involving a target with a “German link”?

In essence, transactions with a transaction value of more than € 400 million will require notification under the new law provided the target has “significant” activities in Germany. The new threshold, which will apply in addition to the current turnover-based threshold, reads as follows:

“(1a) The provisions on the control of concentrations shall also apply, where

- [the combined aggregate worldwide turnover of all undertakings concerned exceeds EUR 500 million],

- in Germany, in the last financial year preceding the transaction,

- a) one of the undertakings concerned had turnover of more than EUR 25 million and

- b) neither the target nor any other undertaking had turnover of more than EUR 5 million respectively,

- the value of the consideration paid in return for the transaction is more than EUR 400 million and

- the target according to No. 2 is significantly active in Germany.”

The first two requirements (para 1a, No. 1 and No. 2a)) are equal to those of the traditional, turnover-based threshold which will continue to be the trigger for most merger cases in Germany. The new threshold will only apply if the third requirement of the traditional test (second undertaking with turnover of EUR 5 million in Germany) is not met (see para 1a, No. 2b)). The third requirement can be replaced by the new “transaction value” test, consisting of two limbs, the “transaction value” according to No. 3 and the local nexus test according to No. 4. But how will this test be applied in practice? Read our analysis below:

Determination of the transaction value

The “transaction value” needs to be determined based on the consideration for the target company (paid in any form), including assumed liabilities (see new Section 38 para 4a ARC). According to the motivation of the law, this includes all assets and other considerations which the seller receives from the buyer in the context of the transaction, in particular monetary payments, voting rights, securities, fixed and intangible assets. It also includes conditional bonus payments or payments in the context of a non-compete agreement.

According to the motivation of the law, any method for the valuation of companies that is recognized in practice, is accepted by the Bundeskartellamt for the determination of the transaction value. In Germany, these are traditionally the Discounted Earnings Method (“Ertragswertverfahren”) or, increasingly, the Discounted Cash Flow Method (DCF), which are both equally recognized for the valuation of companies by auditors. . Another approach is the multiples method (“Multiplikatormethode”) which is recognized if the data for the Discounted Earnings Method or the Discounted Cash Flow Method are not available, i.e. notably for start-ups. The latter method may therefore become particularly relevant for the assessment under the new threshold.

An assessment based on liquidation value will, however, not be accepted. If the parties to a concentration have determined a purchase price based on a valuation of the target, including potential liabilities, this will usually trigger a presumption that the determined value is correct – also for the assessment under the value-based threshold. It is not necessary to obtain additional attestation by accountants.

When is the local nexus threshold fulfilled?

The “local nexus” test is fulfilled if the target is “significantly active in Germany” (see para 1a, No. 4)). The geographical allocation of the target’s activities follows the common rules that are also applicable at EU-level. According to the motivation of the law, the location of the customer is relevant for the geographical allocation of companies’ activities. The decisive criterion is the designated use of the products or services in question. This is where the services are performed or the products are delivered. For example, if users in Germany accept offers by the target or the target undertakes R&D activities in Germany, such activities have to be allocated to Germany.

The novel (and trickier) question is when such activity will be regarded as “significant” in the sense of the law. It is helpful – and recognized by the motivation of the law – that the benchmark for this activity is the second domestic turnover threshold, i.e. a turnover of EUR 5 million. If, for example, the target is (only) active in a mature and fully monetized market in Germany since several years and has not generated EUR 5 million of turnover in this market, no filing is required.

This would be different if the target were engaged in activities that are currently not fully monetized, such as a communication app for smartphones which is currently offered free of charge (or largely free of charge). If such app is used by, for example, 1 million Monthly Active Users, and shall be acquired by a globally active player in the market, it constitutes “significant” activity in the sense of the law, certainly if the app is directed to all consumers as potential users, as explained in the motivation of the law.

Similarly, if a pharmaceutical start-up company sells a pipeline product to a large pharmaceutical company with substantial activity in Germany a filing would be required, if the start-up company had undertaken R&D for the new drug in Germany and it can be reasonably expected that the new drug will be registered and sold in Germany. The benchmark should be whether the target will generate EUR 5 million in Germany in future. The time horizon for this could be five years which is the legal definition of a mature market as enshrined in the minor market exception. Conversely, no filing would be required if – in the same example – no R&D or other activity was carried out in Germany because the target is not “significantly active in Germany”.

Contrary to the old threshold which looks at the turnover generated in the last completed financial year, the relevant time for the determination of the significant activity is the time of the notification in Germany. So in the second alternative of the pharma example above (no R&D in Germany), acquirers who want to avoid a filing requirement in Germany are well advised to wait with the registration of the new drug in Germany until after the acquisition of the target has been completed.

Existing exceptions not applicable

It is important to note that neither the “de-minimis” exception, nor the “minor market” exception foreseen in German law will be applicable to cases triggering the new threshold.

The de minimis clause, exempting cases from merger control if the target is an independent undertaking that had less than € 10 million turnover in the last business year, is not applicable because the reason for the new threshold is exactly the presumed macroeconomic importance of the transactions triggering it. The limited size of the target can therefore not trigger a presumption to the contrary.

Neither is the minor market exception applicable. This exception rule usually declares German merger control non-applicable if the market concerned is one in which goods or commercial services have been offered for at least five years and which had a sales volume of less than € 15 million in the last calendar year. Again, the rationale for the exception does not fit because the assumption behind the new threshold is that the transactions triggering this threshold are in fact important in relation to the German economy as a whole.

________________________

To make sure you do not miss out on regular updates from the Kluwer Competition Law Blog, please subscribe here.